How to Avoid Bad Financial Decisions

Less Bias, Better Judgment

Charlie Munger is Warren Buffet’s right-hand man.

In 1995, Munger gave a now famous speech at Harvard titled “The Psychology of Human Misjudgment” regarding common flaws in human decision making, and why we should be weary of them. There is a great shortened, animated video of that speech here.

Using good judgment to make smart decisions is paramount to successful results, and financial decisions are no exception. It is well documented that investor behavior, defined as the mental processes and emotions that cause investors to buy or sell, is the decisive factor in long term results, rather than knowledge, skill or luck. We might classify these behavioral missteps as the lack of good judgment in financial decision making.

But investor behavior is just one of the many areas where sound judgment and decision making have a major impact on long term success. It turns out that many elite investors, entrepreneurs and executives across the globe see good judgment as the necessary final step to true success. While intelligence, factual acumen, hours of hard work and study, and years of experience can obviously help to make better decisions, they are often not enough to consistently make good decisions over the long term. We also need good judgment.

As advocated by Charlie Munger and others, the path to good judgment is through the use of mental models. Mental models are the “latticework” of human experience and knowledge in which provide a contextual structure for any given situation. This is can be thought of as a systematized or codified version of what we commonly refer to as “perspective”.

Mental models are very helpful in one regard: They seek to limit common unconscious cognitive biases that affect everyone. Cognitive biases can create many pitfalls, and as Charlie Munger believes—it’s amazing how much success one can achieve by simply avoiding the pitfalls.

From a purely anecdotal perspective, I have a few key areas where I see biases creep in and create pitfalls for clients. They are:

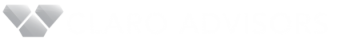

- Recency Bias in Individual Stock Trading Decisions: When clients have exposure to individual stocks, either through personal trading accounts or company equity plans, I often see recency bias—the phenomenon where folks emphasize recent events vs. those from the past which are equally as probable in the near future. If a stock has done very well over the past three months, investors forget about the 40% drop that had occurred 15 months prior. Despite a similar drop being just as likely in the future, investors cling to the recent positive growth as a more probable future trend. I often preach “diversifying after the windfall” and argue that downside exposure presents a bigger risk and the benefit of future upside. Many times, folks want to “let it ride”.

- Envy Based Lifestyle Creep – Charlie Munger and Warren Buffet both believe that envy, rather than greed, drives the world. Envy is on full display when clients increase lifestyle spending to keep up with neighbors to the detriment of their savings rate. This is the cardinal sin of wealth creation. Ultimately, after years of wild spending, folks have to “tighten up” and develop what Munger calls “Deprival Super Reaction Syndrome” as all their toys are taken away—they become angry, like a dog having a bone ripped out of its mouth.

- Liking Distortion Leads to Product Sales – Successful salespeople are generally fun and likeable. They charm you with their engaging personality, funny stories and can prey on your fears (no matter how irrational). The financial advice world, despite many recent improvements, is still crawling with charismatic salespeople and brokers seeking to lock you into a contract that very few humans could every fully understand--like Variable Universal Whole Life Insurance or Structured Products. As Munger explains with “Liking Distortion”, people buy from people they like and avoid people they don’t. But many times, the people you like are selling bad products/advice because you didn’t listen to the less charismatic fiduciary financial planner. “People buy from people they like” is always true but jokes and rounds of golf won’t make up for terrible financial advice.

I’m sure entire books have been written about the subject of common biases clouding financial decisions, but this is a quick summary of my own experience with clients. Next time you make a financial decision, be wary of how your brain might hurt your judgment.

If you need help with any of the above, please schedule an intro call.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab