Most financial advisors might start by proposing different investments or recommending that you buy a product or sell your existing investments. We think differently at Claro. The process starts with you.

Our passion is working with clients to deliver a world-class experience. We love what we do. Our purpose is to simplify and manage your financial life so that you can give attention to the endeavors that you care about and that demand your time.

“Happiness is not in the mere possession of money; it lies in the joy of achievement, in the thrill of creative effort.”

Our team offers a unique combination of experience and energy. Combined with our diverse skill sets, we can offer innovative solutions to any generation of your family.

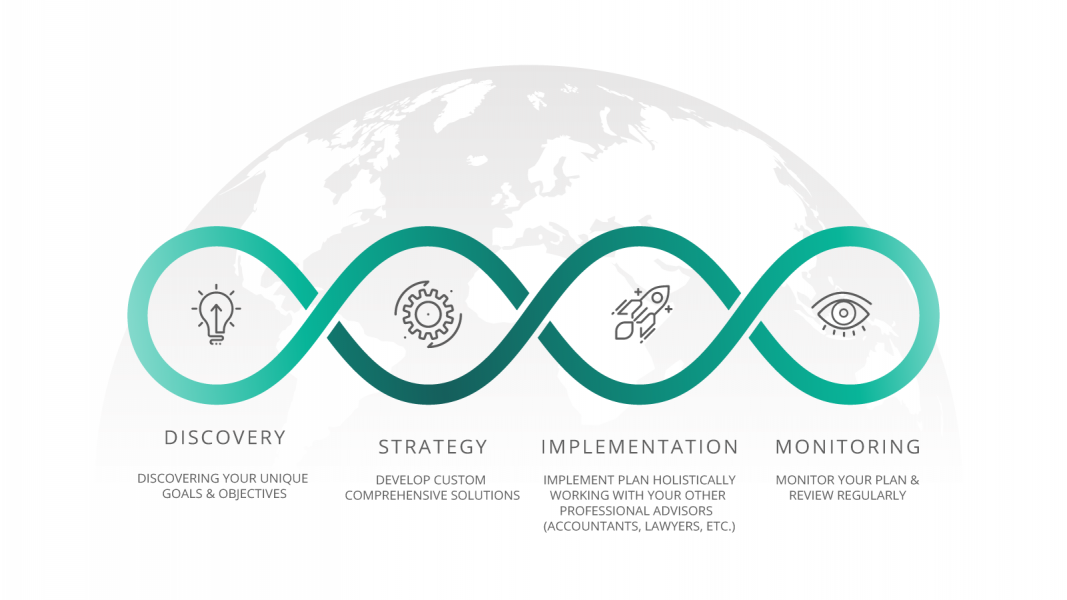

At Claro we believe in providing you with a world-class experience. That’s why we have a tailored process each step of the way, from discovery and strategy to implementation and monitoring, to ensure you’re comfortable with the approach. From the outset of the relationship, we take the time to truly understand your needs through active listening. You will hear from your investment team directly and often. And we treat your assets as if they were our own.

Your experience matters most which is why we’ve constructed a four-step approach to help you understand where we are at each phase of the process.

The relationship begins with a discovery meeting. This helps us get to know you, your family, and your business. We want to hear your story and learn to appreciate how you got to where you are. We’ll ask lots of questions and gather data from you that enables us to better add value to your specific situation.

The relationship begins with a discovery meeting. This helps us get to know you, your family, and your business. We want to hear your story and learn to appreciate how you got to where you are. We’ll ask lots of questions and gather data from you that enables us to better add value to your specific situation.

Disclosure: Claro Advisors Inc. ("Claro") is a Registered Investment Advisor with the U.S. Securities and Exchange Commission ("SEC") based in the Commonwealth of Massachusetts. Registration of an Investment Advisor does not imply any specific level of skill or training. Information contained herein is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Disclosures and Terms of Use.

© 2025 by Claro Advisors Inc. All Rights Reserved.