This may sound absurd to some people, especially those of an older generation, but I almost never advise clients to make an early or lump sum payment on their home mortgage.

It’s not the 1980s anymore, and the financial profile of mortgages have changed for the better.

Thirty or forty years ago, a mortgage was a HUGE DEAL that came at a hefty cost.

Throughout the 1980s, mortgage rates were in the low double digits and ranged upwards of 18% at some points. This was the boom of many real estate markets as the baby boomers entered the working force and began building families. Housing prices skyrocketed, and the cost of borrowing money to purchase real estate went along for the ride.

It’s no wonder that the homebuyers of the 1980s were so eager to pay down this burdensome loan. The interest was absolutely oppressive.

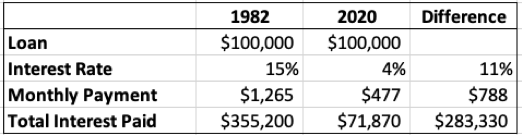

Let’s look at a thirty-year fixed rate loan at 15% for $100k. The monthly payment is about $1,265.

After ten years of payments, the principal balance still stood at $96,025—with total interest paid of $147,758.

The total cost of the home, over thirty years, $455,200.

Clearly it makes sense to pay down principal as soon as possible in this scenario.

Today, things have changed.

The same $100,000 mortgage today would be at, say, 4%. The monthly payment would be about $477.

After ten years the principal would be down to around $78,000. Total cost of the home is only $171,870.

Here’s a side-by-side comparison.

The scars of the 1980s are still present for many current homeowners—and many older folks have indoctrinated their children with the great mortgage scare.

For that reason, I keep hearing the same question whenever there is extra cash or a lump sum liquidity event (bonus, sale of stock, etc.)—Should we use this to pay down our mortgage?

My answer is almost always NO, for the following reasons.

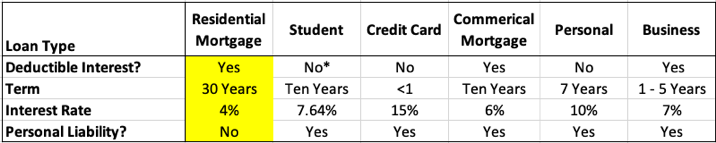

First, outside of a private loan from your rich grandfather, mortgage debt is arguably the most attractive.

-

It’s long term—usually thirty years

-

It’s fixed rate (no surprises)

-

The interest on the first $750k of mortgage debt is tax deductible

-

If for whatever reason you can’t pay it, there is no personal obligation to pay. Creditors have to sell the house to recover the loan.

-

Equity can be extracted tax free through a cash out refinance

Compare this to other types of loans:

I’ve seen situations where it makes sense to borrow as much as possible on a home to simply knock out all the other debts on a balance sheet. For example, someone has $400,000 in home equity and owes $75,000 in student loans for their children. They could simply “shift” the loan liability from student loans (horrible rate, not tax deductible, NOT DISCHARGEABLE EVEN IN DEATH) to an increased mortgage at a low, tax-deductible rate. This may sound aggressive, but it’s hard to argue with the numbers.

Second, the opportunity cost of having your available cash in a house is too high. In other words, it makes sense to invest money towards other long-term goals rather than use it to extinguish very favorable debt.

On one hand there is mortgage debt at a tax-deductible 4%. If you chose to keep that debt to finance another goal, here are some options:

-

Tax free municipal bonds, which have a ten-year average return of about 4.5%

-

Invest in a 529 fund that will grow tax free at 5 – 7% for more than ten years

-

Invest in a balanced taxable investment account that will seek, net of taxes, 6%

These strategies have the added benefits of keeping liquidity available for unforeseen contingencies.

Whether you wish to reduce liabilities or increase assets—it makes sense to keep (or increase) mortgage debt in both scenarios. The overall goal is increased, efficient net worth. It’s more nuanced than “debt is bad, and it must go.”

Disclaimer

A few things to note about this. First, debt is a financial tool that can be used for good or evil. While a well-oiled chainsaw can make yardwork easier, it could also cut off a limb if used without caution or skill.

The same goes for borrowing money. Here are some assumptions that must be in place to leverage mortgage debt to meet your goals.

-

Have sufficient equity in the property. You don’t want to go “under water”. In other words, if you have low equity and/or pay PMI, it would make sense to pay down some mortgage debt.

-

Have sufficient cash flow to cover the payment, or increased payment. Even if you have a great investment opportunity, you have to cover the monthly payment with ease.

-

Despite the advertisements from banks and mortgage lenders, do not borrow to cover lifestyle consumption expenses. It’s almost never a good idea to refinance on a home to go on vacation or buy that boat you always wanted. This is how you rapidly decrease net worth and damage household cash flow.

But whatever you do, just keep an open mind the next time you feel the urge to pay off your mortgage. There might be better options.