Wednesday, 30 October 2019

529 Plans Are Your Friend

I’m often surprised by the level of skepticism I hear regarding 529 college savings plans.

The 529 plan allows for easy investment choices, tax free growth and tax-free distributions to pay for college. With an early start to funding, this can create tens of thousands in savings for a family over the many years leading up to college.

Friday, 11 October 2019

So many of my clients express a huge desire to save for their kids’ college educations at the expense of their own retirement. I’ve also seen parents mortgage their home and liquidate portfolios to make tuition payments. As soon as an acceptance letter arrives from a target school (or any school, sometimes)—the examination of cost is almost absent from further action. It becomes “pay the bill by any means necessary.”

Friday, 06 September 2019

Work With Someone That Does It All

In a prior article I explained how advisors add value to investment accounts, but the value of financial advice extends well beyond investments. Worthwhile financial advice professionals should seek to grow and protect a client’s total net worth—rather than simply maximize investment return on liquid assets.

Friday, 09 August 2019

Don't Freak Out About Investments

A few studies have examined the value of financial advisors, from an investment standpoint. They all seem to conclude the same thing—that the value of a financial advisor is not in finding the best investments but, rather, designing a basic, workable plan, and more importantly, serving as an accountability partner and barrier from making a big emotional mistake.

Wednesday, 24 July 2019

Dynamic Withdrawal Strategies for Retirees

We showed that the 4% rule is an insufficient guide for retirement withdrawals. Here are some strategies that can help retirees make their money last.

Friday, 12 July 2019

Don't Run Out of Money

Per following the 4% rule, you've dutifully saved over your working years and are now ready to retire. You plan to withdraw 4% annually in retirement.

But the 4% rule alone will not guide you to retirement success. In this article I outline a few shortfalls with this famous rule-of-thumb, and why you need to be weary of them well before your actual retirement.

Monday, 17 June 2019

High Earners, You Can Fund Roths Too

Roth accounts are the holy grail of retirement savings. While taxed in the year of contribution, once in a Roth, funds are tax free forever. No tax on investment, or withdrawals, or even distributions to your kids when you’re gone and they’re fighting over your estate.

But high earners face an uphill battle in funding Roth accounts. Direct contributions to a Roth IRA aren’t allowed for households earning more than $203,000. Here are few workarounds.....

Thursday, 30 May 2019

When Your Income Dips, Convert to Roth

Arbitrage is a fancy word used in finance conversations by people that really want to seem smart.

Today, I’m excited to be one of those people.

Roth conversions during low-income years can be a great way to set money freeforever at a reduced tax rate. This strategy works well for those that have accumulated a high balance in traditional IRA or 401(k) through pre-tax contributions, and will have a low-income year because of a decision to retire, start a business, or become an instagram life coach.

Thursday, 09 May 2019

Beat the Index With Consistent Tax Alpha Over Time

Why high-earners should own a "personalized ETF" and consistently sell loss positions to boost after tax returns.

Thursday, 25 April 2019

Everyone should do it, but few do.

At the end of every year, take a look at your portfolio and sell whatever is "down" to capture a tax loss. If you still like the investment, buy it back after thirty days. If not, buy something else.

This annual exercise can create huge value over several years of investing.

Friday, 05 April 2019

Diversify Your Windfall

After an IPO, employees that hold equity should sell their shares and avoid the urge to "let it ride"...

Monday, 11 March 2019

Pay A Little Now, Save A Lot Later

Early stage employees have a unique opportunity to place their future economic gains into preferential tax classifications. It just takes a little effort and some cash.

Monday, 25 February 2019

Make Hard Decisions Now For Better Results Later

Equity compensation is a broad category of various ownership grants given to employees, founders and investors throughout a company’s lifecycle. If managed properly, equity compensation can provide an economic windfall that turbo charges a wealth plan.

Monday, 11 February 2019

Invest Money Now, Pay Taxes Later

A little discussed provision of the Tax Cuts and Jobs Act of 2017 allows for investors to invest taxable capital gains directly into an “Opportunity Fund” and defer paying taxes. There is a 10% and 15% basis increase after holding the Opportunity Fund for five and seven years, respectively. Any gains on Opportunity Fund investments are tax free if there is a holding period of ten years or longer.

Monday, 28 January 2019

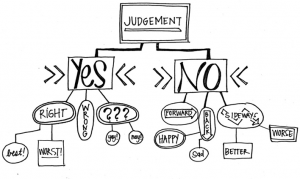

Less Bias, Better Judgment

Using good judgment to make smart decisions is paramount to successful results, and financial decisions are no exception. It is well documented that investor behavior, defined as the mental processes and emotions that cause investors to buy or sell, is the decisive factor in long term results, rather than knowledge, skill or luck. We might classify these behavioral missteps as the lack of good judgment in financial decision making.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab