Stop Avoiding Decisions on Equity Compensation: Part III - Don't Let FOMO Ruin Your Finances

Diversify Your Windfall

For equity holders in a private company, a public offering can translate economic value (paper gains) into actual cash.

This is the realization of a windfall.

The post-windfall planning strategy is about managing downside, applying the cash towards personal priorities, and avoiding the lure of playing “one more hand” at the casino by holding shares with no defined exit plan.

Diversification is a must at this point.

In my experience, unhelpful emotions can really prevent sound decisions here. There are three common situations:

1. Stock options were never exercised and there are now high taxes.

2. Stock options were exercised, and there are (relatively) low taxes to pay upon sale.

3. RSU grants are vesting quarterly with little tax implications upon sale.

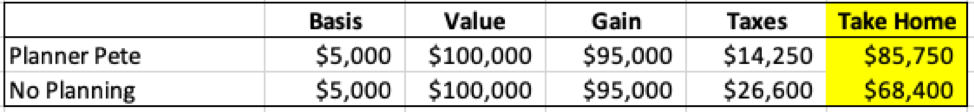

Here’s how it would look for Planner Pete vs. someone that did no planning from the last article.

Taxes are a tough pill to swallow—no doubt. But regardless of the tax consequences from selling stock, I would recommend both people to sell the stock and keep their money after a 20x return. Don’t play another hand.

Folks never really want to sell because they’re holding onto hope (real or imagined) that the stock will appreciate further. In other words, the perceived opportunity cost of selling the stock is too high—they have FOMO.

“Not sure if I want to sell now, I think we could double or triple in the next year.”

This is just like someone that wins big at a casino and keeps playing. If someone wins $50,000 playing roulette, they should simply walk away and stop trying to recreate the windfall. They’ve paid for their entire trip, and probably four or five more vacations. But they think can go 10x again…..

The difference is that early stage company bets require relatively low capital risk, with huge upside potential. After the windfall the risk/return metrics shift. Folks now have their entire nest egg in an asset that has already experienced multiples of growth. Now you are risking much more money.

Develop a plan to consistently sell your holdings in a way that is mindful of taxes. Then apply the proceeds against your personal financial goals.

For everyone that receives RSUs post-IPO: TREAT THEM AS A VARIABLE CASH BONUS AND SELL IMMEDIATLEY AT VEST

RSUs are very common, especially in tech.

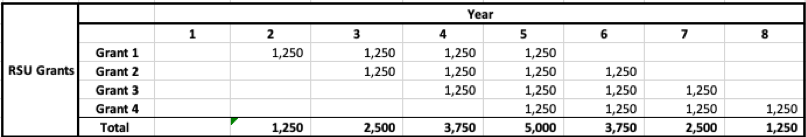

Let’s look at a quick example. Danny Director signs on with Techflow, Inc. two years after an IPO and receives 5,000 RSUs, vesting 25% over four years. He receives the same grant for the following three years—total RSU grants of 20,000 that star, vesting over eight years on the following schedule.

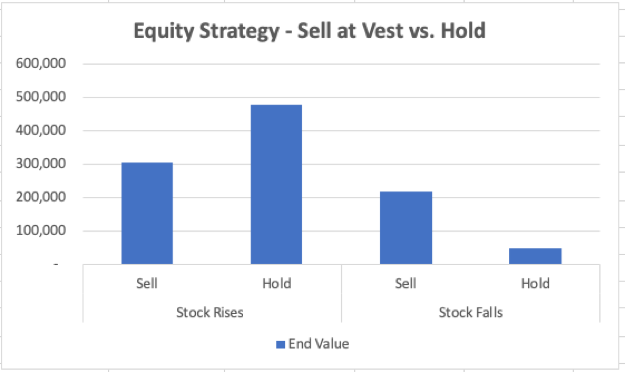

Now let’s examine a “sell at vest” vs. “hold forever”. Our sell at vest assumes post-tax proceeds go into a diversified account that earns an average return of 7%.

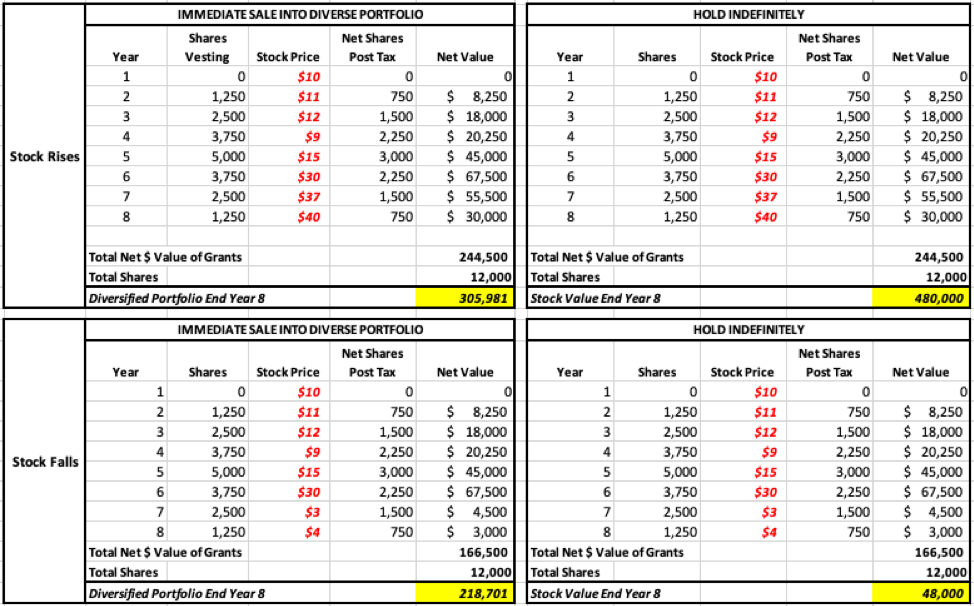

1. Stock Falls Scenario- Stock initially rises, then crashes towards the end.

2. Stock Rises Scenario- Stock steadily rises with a big pop in later years.

Here are the four scenarios with each year broken out.

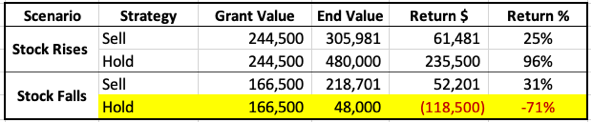

And here’s the summary with a visual graph for comparison

Just to address the obvious, the “sell at vest” strategy never comes out on top if shares continue to appreciate. Folks need to be ok with that (and many aren’t!). Successful long-term decision making is about playing the odds, and the “sell at vest” strategy forces trading the best possible scenario to avoid the worst possible scenario.

RSUs are just deferred compensation tied to company performance. With this strategy you mitigate downside risk, and still participate in upside.

Selling at vest makes sense because the worst-case scenario hurts you MUCH more than the best-case scenario helps you.

You shouldn’t risk (almost) everything to (possibly) gain a little more. A bird in the hand is worth two in the bush. Don’t be greedy. You get the point….with a “hold forever” strategy, there is almost never a point where it makes sense to sell. The flipside is that the strategy is ALWAYS carrying heavy risk.

Every investment needs an exit plan.

As the charts show, you still participate in upside as the company does better. But you participate much less in downside.

Bringing This Back to Fundamentals….

Goals based financial planning is about meeting financial priorities through informed, disciplined and sustainable actions. Sticking to fundamentals makes decisions easier.

With this strategy, we’re removing guesswork and keeping decisions simple with the goal of avoiding the “big miss” and staying on track through minimizing company risk but keeping some return.

Don’t worry about what your co-workers are doing. Understand your own personal situation and have a plan to execute your goals that removes as much risk and contingency as possible.

Don’t let FOMO ruin your finances.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab