Stop Avoiding Decisions on Equity Compensation: Part II - Early Stage and Pre-IPO

Pay A Little Now, Save A Lot Later

Tax Nerd Trigger Warning: Tax assumptions are extremely basic here, please don’t berate me.

In this piece I want to discuss the common questions and issues with regards to pre-IPO companies that issue stock option compensation to early employees.

Once the company has gone to market and hired a few dozen (or hundred) employees, ISO and/or Non-qualified stock options ("NQOs") are very popular forms of equity compensation. From an economic standpoint, this just means the grant price (the strike price) to buy the stock is fixed, even if share value increases. When stock options appreciate beyond their strike price, they are said to be “in the money”.

This is when decision leverage is high, and planning can have a much larger impact.

Action: If you believe the price of the stock is more likely than not to increase, exercise your options to minimize taxes on future appreciation.

If you wait, and the shares increase further, your taxes at exercise increase as well.

What you need to know: Total out of pocket cost to exercise (purchase price + taxes).

1. Cost to buy your shares (total vested shares multiplied strike price)

2. Taxes owed (FMV less strike price multiplied by applicable tax rate)

Add 1 and 2 above. You will need cash on hand to pay those costs.

Risks: YOU LOSE YOUR TOTAL INVESTMENT. If the company goes under, you don’t recover anything, including the taxes you paid at exercise. This does happen.

Generally, though, stock options are an asymmetrical investment opportunity in investing X creates return potential at several multiple of X. The key is to make an informed decision about the probability that the stock appreciates, but more importantly, to know that you can withstand the loss (even if it’s unlikely).

What about RSUs? Early stage RSUs require a different strategy called the 83(b) election, but basically, you’re recognizing the current value of all vested and unvested RSUs as taxable income, so that you can place future growth into the preferential capital gains bucket.

Example: 10,000 RSUs issued at a value of $1 per share, vesting over five years. You “elect” to recognize the full value of your shares NOW (and pay tax on $10k), so that any future growth is at capital gain rates, rather than higher ordinary income rates.

Stage Two: Pre-IPO

The company has done well for a few years, has hundreds of employees, and the stock FMV has grown in multiples from the first year. The planning strategy here is pretty similar to what we just covered, with the key difference that things will be more expensive because the stock is more valuable and the taxable spread is higher.

So, in sum, it’s now even more expensive to exercise the shares, but not necessarily riskier. There is arguably lower risk of loss because the company is more established. The “buy-in” is higher, but folks are buying into something a little safer because the company is THAT MUCH closer to IPO.

Actions: Exercise what you can prior to IPO to lock in capital gains rate.

Obstacle: For certain companies it won’t be an option to come out of pocket to exercise. It’s just too expensive. In that case, folks have to hold (and kick themselves for not exercising earlier).

Here’s an example. Two friends—Planner Pete and Busy Bill— join TechFlow, Inc. at the same. They are each issued 5,000 ISOs vesting immediately at a strike price of $1 per share.

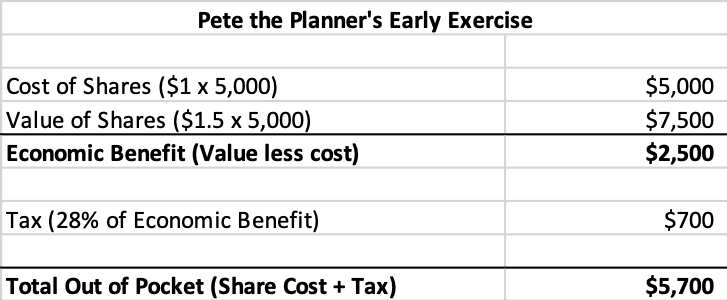

After six months TechFlow, Inc. has enjoyed growth and fantastic media coverage. The shares are now worth $1.50 based on a 409A valuation.

Pete exercises his options, but Bill is too busy and doesn’t understand the tax consequences—so he just ignores them.

Pete pays $5,000 to exercise his options ($1 x 5,000 shares) and has AMT income of $2,500 ($1.5 - $1 x 5,000) taxed at 28%, for a total tax bill of $700. Pete’s out of pocket cost is $5,700.

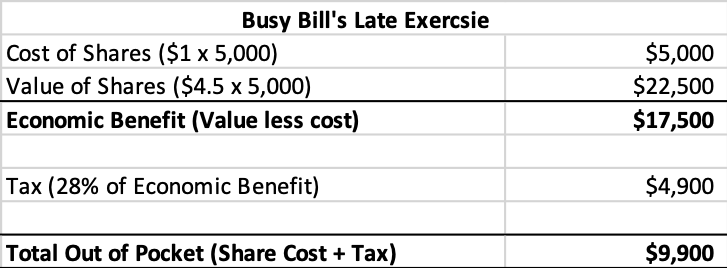

Two years later…TechFlow has been very successful and an IPO is imminent within the next year. The stock price is now at $4.50.

Planner Pete is ecstatic because he exercised early. Everyone at the office wonders what to do about their options, and Busy Bill sits down to consider his choices. He’s not going to like what he sees….

Bill waited so long that exercise is almost prohibitively expensive, and he may not have enough funds to cover the out of pocket expenses. He needs $9,900 to exercise his shares ahead of IPO.

Should he still do it? Probably, but this is what I warned about earlier. For some, it’s not an option because they don’t have enough savings. But it still makes sense when we consider that the stock could still return multiples above the current value of $4.50.

There is still a planning opportunity.

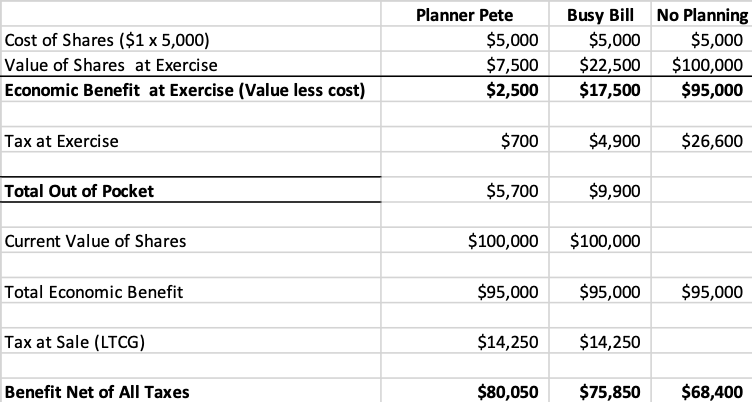

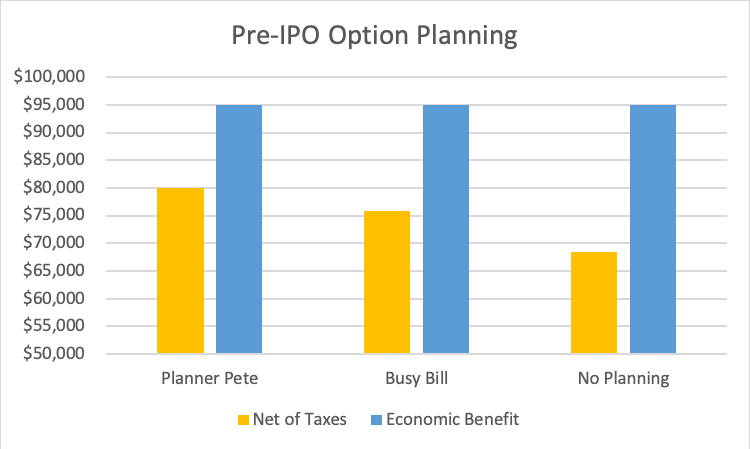

We’ll assume Bill pulls together the funds necessary to exercise. Here’s how the numbers play out for Pete and Bill vs. someone that doesn’t exercise anything, assuming a $20 share price at IPO.

The core lesson is that the economic benefit of $95,000 is the same for everyone (5,000 shares at $1 purchase price and $20 value at IPO), but the taxation of the benefit varies greatly.

The exercise strategy is to capture as much potential benefit into the preferential long-term capital gains rate at sale, and avoid paying the high AMT (or worse, ordinary income rates) at exercise.

If appreciation is likely, the out of pocket cost now is worth the tax benefits later. Take a few hours to plan, and maybe your small investment now will save you thousands (or more) later. As you get closer to IPO, exercise becomes less risky but more expensive.

NOTE: AMT taxes have a changed as a result of the Tax Cuts and Jobs Act of 2017, and now far fewer folks will be subject to AMT. This makes early exercise even more attractive!

In my next piece I’ll discuss why the decision-making process changes when the stock becomes liquid after a windfall, and diversification becomes the driving factor.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

Related Articles

- An Effective Stock Option Strategy for Startup Employees

- Dear Young Investors: Stop Micro-Managing Investments and Become Market Agnostic

- What To Do With All Those RSUs?

- Effective Financial Planning for Young Professionals

- My Company Was Acquired - Now What?

- Stop Avoiding Decisions on Equity Compensation: Part I - The Basics

- Stop Avoiding Decisions on Equity Compensation: Part III - Don't Let FOMO Ruin Your Finances

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab