Tuesday, 16 October 2018

Nobody likes paying high premiums for family health insurance coverage. If premiums seem very high, it’s because they are.

In fact, the cost of family healthcare premiums has increased 55% in the last ten years. What was once a negligible payroll deduction is now a major household expense that could very likely exceed expenses like real estate taxes, car payments or mortgage interest.

But ask yourself—why continue to pay such high premiums if you don’t require significant ongoing health services? Total premiums could be $10,000 per year, but the gross amount of medical care may only be $3,000 - $4,000.

Tuesday, 25 September 2018

"Too much information can serve to artificially inflate our confidence so that we increase our bets without any greater ability to predict the outcome of future events."

Adam Robinson is a macro global advisor to some of the largest hedge funds and ultra-high-net-worth family offices. As a child, he was a chess prodigy tutored by the legendary Bobby Fisher. As a young adult, he created the now ubiquitous Princeton Review SAT prep course—which he later sold for a handsome reward. Based on my admittedly limited knowledge of Robinson, his “magic” lies in developing mental models for key decisions to maximize performance and efficiency. He’s like a chess master for life.

In a recent interview, the interviewers asked Adam what types of “bad advice” he often hears related to his profession of global finance and investing. Adam responded with an interesting story that has profound value for all types of investors.

Thursday, 06 September 2018

In common use, the term “Stoic” describes someone that is confident, quiet, stable and purposeful.

Stoicism, however, is an Ancient Roman philosophy that provides practical life advice for anyone wishing to better themselves. Legendary entrepreneur Tim Ferriss described Stoicism as a “personal operating system”. High performing Stoicism-enthusiasts include Bill Belichick, Nick Saban, Bill Clinton, Ralph Waldo Emerson, and Theodore Roosevelt.

Tuesday, 03 April 2018

Long term care is a grim but necessary topic for older Americans. It’s easy to understand why most folks would ignore this issue.

Long-term care is unpleasant, expensive and there are few palatable ways to fund the expense. Unfortunately, the issue isn’t going away, and the earlier folks consider the problem, the sooner they’ll find a viable solution.

For purposes of retirement planning, the most productive way to think about long-term care (and funding options) is to consider the need for long-term care to be more likely than not contingent event and to view any insurance policy as the pre-funding of a future expense (for more on this read the always fantastic Michael Kitces).

Wednesday, 25 October 2017

Many employees receive restricted stock units (RSUs) as part of their compensation, but few develop a strategy to incorporate RSUs into their wealth plan.

After working with several RSU grantees, here are some simple answers to the most common question I hear from clients: “What should I do with my RSUs?"

Before we get there, let’s just go over the basic rules of RSUs and how they play out in a wealth plan.

RSUs are a grant of shares of company stock in lieu of cash. From a payroll standpoint, they are treated as cash, with similar withholding requirements and subject to ordinary income tax when received (or “vested”). Here’s an example:

Thursday, 19 October 2017

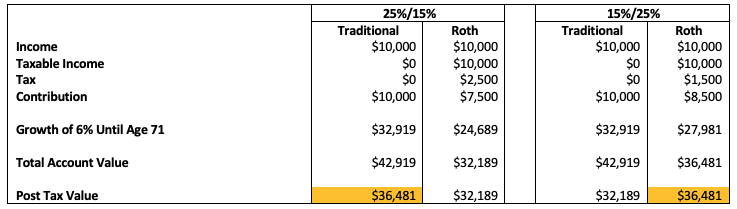

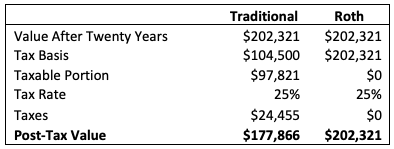

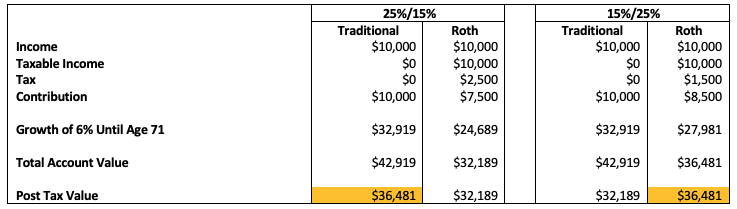

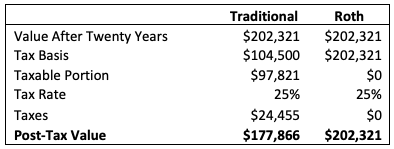

The Roth IRA may be the holy grail of personal finance. For those unfamiliar with the difference between Roth and traditional retirement accounts, here is a brief synopsis and an example to illustrate.

A traditional IRA or 401(k) is funded with (mostly) pre-tax funds, where the principal balance grows tax-deferred, but is subject to unfavorable ordinary income tax rates upon eventual distribution. In order to avoid perpetual tax-deferment, there are mandatory liquidations (known as RMDs) for account owners older than age 70.5.

Thursday, 12 October 2017

Asset allocation is big theme in today’s investing landscape.

Hedge fund managers and “DIY” investors alike understand the importance of asset allocation—namely that by owning multiple asset classes, investors can reduce risk without reducing expected returns. Sustainable risk-adjusted returns are a necessary component of any disciplined portfolio.

We often hear about tax loss harvesting, but for most investors with only a handful of taxable holdings, there is little to gain in selling for losses at year end.

Thursday, 28 September 2017

The real estate market in coastal cities is booming.

Here in Boston, property values and rents have skyrocketed since the Great Recession and there are similar trends in other large metropolitan areas. Many young people that purchased in the “right neighborhoods” have significant equity in their homes.

For those young families seeking a sprawling suburban home, it seems reasonable to sell the city condo at a massive gain and roll the equity into a down payment on a larger family home. But is that the best strategy?

Before listing the condo and cashing in on the red-hot sales market, young urbanites should review all their options to make sure that selling is the best strategy for long-term wealth.

Monday, 21 August 2017

Summer is an ideal time to evaluate the progress of your annual financial goals, and get an early start on executing goals with a calendar year-end deadline.

Summer is an ideal time to evaluate the progress of your annual financial goals, and get an early start on executing goals with a calendar year-end deadline. With slower work environments and the busy fall on the horizon, take advantage of some downtime to ensure your financial success. Although financial planning might be the last thing on your mind as you sip a cocktail on the beach, giving some thought towards end of year planning can mean all the difference between proper executing and falling behind.

There are many seemingly small annual tasks that should be part of any sound financial plan, and while these tasks are conceptually simple, effective execution can require effort and planning. Now is the time to check in on progress, and start crossing things off the list.

Tuesday, 13 September 2016

In football, we all love watching the big play.

In football, we all love watching the big play. Long passes, acrobatic catches and punishing runs make for great entertainment. A high scoring offense can mean championships for the team, but as most diligent coaches and General Managers know, a good offense needs solid protection.

Assets Require Protection, and Quarterbacks Are No Different

It really doesn't matter who plays quarterback if no one blocks the defense.

NFL teams view their quarterback as an asset and seek immediate protection in the form of a talented offensive tackle. While offensive tackles provide run and pass blocking, they also protect the quarterback from devastating hits that could ruin a play, or even worse, an injury.

Friday, 17 June 2016

Inexperienced investors have trouble relinquishing their hard-earned funds to the ebbs and flows of market returns.

Inexperienced investors have trouble relinquishing their hard-earned funds to the ebbs and flows of market returns. People just don’t want to buy and hold for the long term because there is a sense that boring diversified portfolios should be "doing more", or that investors should frequently react to market forces.

Rather than investing in a portfolio of low-cost index funds with an appropriate asset allocation and risk tolerance, and then stepping back (other than to rebalance and harvest tax losses), many young investors pay attention to market swings and act on impulse. They listen to pundits and succumb to media pressures to react in fear. Despite warnings, they try to time the market.

Unfortunately, this overactive behavior can undermine investment goals.

The Horrifying Results for Most Investors

Several studies have shown that the vast majority of all investors fail to achieve the returns of their own investments.

It sounds impossible, but let that sink in.

Tuesday, 17 May 2016

So you’ve just landed a new job after several years in your last position.

So you’ve just landed a new job after several years in your last position. You worked hard to establish yourself and develop the skills necessary for success, and now you’re ready for a higher level of responsibility and benefits.

A mid-career change can be both exciting and daunting. Once again you’ll be out of your comfort zone and looking to prove yourself in an unfamiliar environment.

Of course, there’s a new office and set of colleagues, but there’s also a chance to change many other areas of one’s life that may need improvement or adjustment. A new income and benefits package could mean entirely different financial circumstances.

Tuesday, 03 May 2016

It’s true that timing is everything.

It’s true that timing is everything. For individuals that receive stock options during a company’s startup or pre-IPO phase, there can be an acceleration of wealth that is unlike any other form of employee compensation. Working at a startup can provide the right mix of entrepreneurial upside with the stable salary and benefits of a competitive full-time job.

Although many people realize benefits of stock options and sometimes layer the proceeds from options into a long-term wealth building strategy, most do not understand the substantial planning opportunities available to minimize taxes around the exercise of options.

A well-timed stock option exercise and hold strategy with a sale at capital gains rates can provide significant tax savings. From a wealth planning standpoint, it can be lightning in a bottle.

Stock Option Basics

A stock option grant is simply the right (or option) to purchase one share of company stock at a set price.

For example, Startup, Inc. could grant Eddy Employee 1,000 stock options at $5/share (known as the strike price). Eddy can now choose, within some set time frame, to purchase (or exercise) the options at the strike price of $5.

Friday, 15 April 2016

By age thirty, personal financial planning becomes, in many cases, necessary for long-term success.

During their twenties, people are finding their way personally and professionally. Long nights at the office as “low man on the totem pole” can turn into a mid or senior level position and a well-established career track by the age of thirty.

Likewise, the twenties lifestyle of living with friends and going out on weekends gives way to marriages, families, and moving to the suburbs. By age thirty or thirty-five, especially when children enter the picture, there is less discretionary time and money, so every dollar needs to count.

For individuals approaching thirty and beyond, here is a quick litmus test to see whether you have a handle on your financial situation. If you can’t affirmatively answer these questions, your financial plan may need attention.

- How Much Do You Save Each Month?

Everyone knows what hits their bank account each pay period. Some people know their monthly spending number. Very few people know their monthly savings, or deficit, number. This number could include retirement account contributions from payroll, but in general, people should have a good idea of the portion of their monthly income that goes towards achieving their long-term financial goals.

Friday, 01 April 2016

Why Early Retirees Should Reconsider the 4% Rule

Getting on base and ultimately crossing home plate are two very different things. Even after a fantastic at-bat, a subsequent mental lapse on the base path could end a scoring chance and possibly lose a game.

For individuals that have "reached first base" in saving enough to stop working, retirement success could require a whole different mindset than successfully saving for retirement. Actually, the first five years of retirement can mean the difference between winning and losing. Although retirement rules of thumb can be helpful with long-term goals, when it comes time to tap into retirement assets, retirees need flexibility and proactive risk awareness.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab