Monday, 14 January 2019

Navigating a Potential Windfall

While folks may not have a full grasp on their employment picture over the short term, as consolidation means many things to many different people, one area of worthwhile focus is the effect of ownership change on personal finance and retirement planning.

How does this acquisition affect your current retirement plan? Major transitions are a great time to take another look at everything and see how you can solidify your finances, despite short-term uncertainty.

Monday, 07 January 2019

Just a Quick Note on Annual Investment Outlooks…

Each year, seemingly thousands of financial institutions, professional investors and everyday financial advisors provide a forward-looking outlook for the coming year. These outlook papers serve as forward-looking predictions for the market and economy. Ostensibly, investors leverage these insights to position their portfolios for success.

There is no shortage of intellectual geniuses in the investment community. For decades, the brightest, most ambitious go-getters from all over the globe have flooded into asset management firms in search of their investment fortune. I won’t pretend to be half as smart as these folks. I’m not a CFA, nor do I play one on TV.

Tuesday, 18 December 2018

There are two stages of retirement planning - accumulation and distribution.

There are two stages of retirement planning - accumulation and distribution. Accumulators are those still working (and who we’ll discuss here). Distributors are those that are no longer working and live off their assets and passive income streams (to be discussed later).

Here’s a graphic showing the lifecycle of a good financial plan from working years (accumulation phase) to retirement years (distribution phase).

Friday, 07 December 2018

A few months back I listened to very popular podcast for financial advisors

The guest was an advisor that experienced great success at a young age as a traditional Wall Street broker but had since moved into the fiduciary world (the better world of wealth management). After decades of advising thousands of clients, he made a comment that greatly resonated with me regarding investment choices.

He said that with less than $500k in equity exposure, folks should just buy Vanguard’s Total World Stock ETF for equity exposure.

From the podcast transcript:

And with these younger people, I’m always like, “Hey listen, just go to Vanguard, buy this thing, the VT, for the next $250,000. And when you get there, call me.” Now, little do they know I’ll just keep saying, “Well, do that again until you get to half a million then call me.”

This advisor only works with clients with greater than $500k to invest, so this recommendation was within that context (ie. don’t call me until you have $500k). But hearing this from an industry veteran that has made a lifelong living of being the “investment guy” for many wealthy clients was intriguing.

Tuesday, 20 November 2018

I’ve already explained the economic and tax advantages of HSAs.

Now, let’s talk about how to optimize HSA funding with an IRA rollover to provide a “cushion”, some resources for where to spend your HSA funds on everyday “health expenses”, and how to be a smarter healthcare consumer.

Funding – IRA to HSA Rollover

Married couples can contribute up to $6,900 annually to HSAs. Generally, open enrollment season is in October or November, but benefit changes technically don’t go into place until January first of the following calendar year. You have to wait until your HDHP plan goes into effect to contribute to your HSA.

Tuesday, 30 October 2018

Competent investment management is a commodity service—and this is no secret.

For the past decade, institutional and retail investors alike have chosen low-cost passive index funds over higher cost actively managed strategies because active managers can’t consistently beat the index, but still, charge high fees for trying. Here are the numbers for active managers vs. the index from a Wall Street Journal article:

Tuesday, 16 October 2018

Nobody likes paying high premiums for family health insurance coverage. If premiums seem very high, it’s because they are.

In fact, the cost of family healthcare premiums has increased 55% in the last ten years. What was once a negligible payroll deduction is now a major household expense that could very likely exceed expenses like real estate taxes, car payments or mortgage interest.

But ask yourself—why continue to pay such high premiums if you don’t require significant ongoing health services? Total premiums could be $10,000 per year, but the gross amount of medical care may only be $3,000 - $4,000.

Tuesday, 25 September 2018

"Too much information can serve to artificially inflate our confidence so that we increase our bets without any greater ability to predict the outcome of future events."

Adam Robinson is a macro global advisor to some of the largest hedge funds and ultra-high-net-worth family offices. As a child, he was a chess prodigy tutored by the legendary Bobby Fisher. As a young adult, he created the now ubiquitous Princeton Review SAT prep course—which he later sold for a handsome reward. Based on my admittedly limited knowledge of Robinson, his “magic” lies in developing mental models for key decisions to maximize performance and efficiency. He’s like a chess master for life.

In a recent interview, the interviewers asked Adam what types of “bad advice” he often hears related to his profession of global finance and investing. Adam responded with an interesting story that has profound value for all types of investors.

Thursday, 06 September 2018

In common use, the term “Stoic” describes someone that is confident, quiet, stable and purposeful.

Stoicism, however, is an Ancient Roman philosophy that provides practical life advice for anyone wishing to better themselves. Legendary entrepreneur Tim Ferriss described Stoicism as a “personal operating system”. High performing Stoicism-enthusiasts include Bill Belichick, Nick Saban, Bill Clinton, Ralph Waldo Emerson, and Theodore Roosevelt.

Monday, 09 July 2018

I've heard it everywhere. On tv, the local radio team whispered amongst corporate executives. "They just don't work hard." "Their attitude sucks." "They don't know what it's like in the real world." Stop me if you know who I'm referring to.

Below is my attempt at the World v. Millennials case outlining beyond a reasonable doubt that millennials are NOT GUILTY of the overwhelming cultural charge against them as being "just the absolute worst group of people." Admit it, you've heard it too, or worse- you think it.

Tuesday, 03 April 2018

Long term care is a grim but necessary topic for older Americans. It’s easy to understand why most folks would ignore this issue.

Long-term care is unpleasant, expensive and there are few palatable ways to fund the expense. Unfortunately, the issue isn’t going away, and the earlier folks consider the problem, the sooner they’ll find a viable solution.

For purposes of retirement planning, the most productive way to think about long-term care (and funding options) is to consider the need for long-term care to be more likely than not contingent event and to view any insurance policy as the pre-funding of a future expense (for more on this read the always fantastic Michael Kitces).

Wednesday, 25 October 2017

Many employees receive restricted stock units (RSUs) as part of their compensation, but few develop a strategy to incorporate RSUs into their wealth plan.

After working with several RSU grantees, here are some simple answers to the most common question I hear from clients: “What should I do with my RSUs?"

Before we get there, let’s just go over the basic rules of RSUs and how they play out in a wealth plan.

RSUs are a grant of shares of company stock in lieu of cash. From a payroll standpoint, they are treated as cash, with similar withholding requirements and subject to ordinary income tax when received (or “vested”). Here’s an example:

Thursday, 19 October 2017

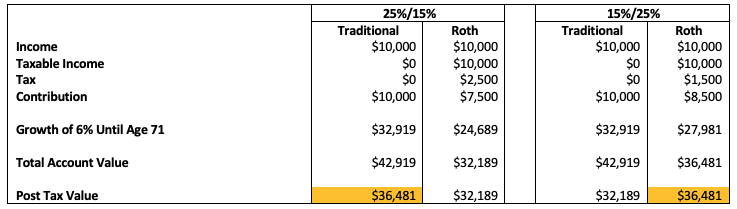

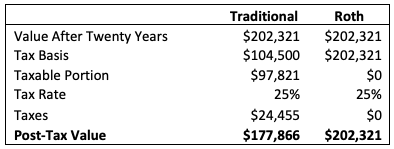

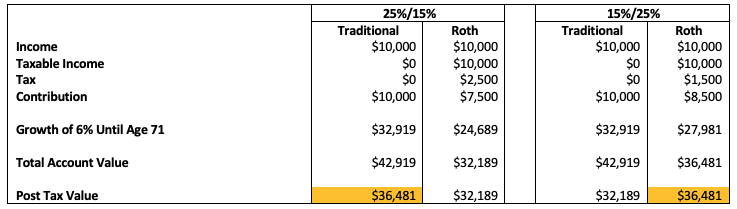

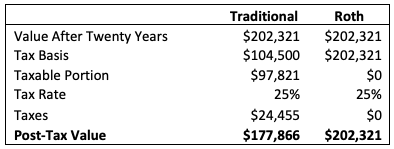

The Roth IRA may be the holy grail of personal finance. For those unfamiliar with the difference between Roth and traditional retirement accounts, here is a brief synopsis and an example to illustrate.

A traditional IRA or 401(k) is funded with (mostly) pre-tax funds, where the principal balance grows tax-deferred, but is subject to unfavorable ordinary income tax rates upon eventual distribution. In order to avoid perpetual tax-deferment, there are mandatory liquidations (known as RMDs) for account owners older than age 70.5.

Thursday, 12 October 2017

Asset allocation is big theme in today’s investing landscape.

Hedge fund managers and “DIY” investors alike understand the importance of asset allocation—namely that by owning multiple asset classes, investors can reduce risk without reducing expected returns. Sustainable risk-adjusted returns are a necessary component of any disciplined portfolio.

We often hear about tax loss harvesting, but for most investors with only a handful of taxable holdings, there is little to gain in selling for losses at year end.

Thursday, 28 September 2017

The real estate market in coastal cities is booming.

Here in Boston, property values and rents have skyrocketed since the Great Recession and there are similar trends in other large metropolitan areas. Many young people that purchased in the “right neighborhoods” have significant equity in their homes.

For those young families seeking a sprawling suburban home, it seems reasonable to sell the city condo at a massive gain and roll the equity into a down payment on a larger family home. But is that the best strategy?

Before listing the condo and cashing in on the red-hot sales market, young urbanites should review all their options to make sure that selling is the best strategy for long-term wealth.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab