Tax Loss Harvesting Part I - Take the Easy Money

Everyone should do it, but few do.

Tax loss harvesting is part of any sound portfolio management plan. This piece goes over the basic concepts of tax loss harvesting and sketch the value proposition of this “easy money” strategy.

Investing Taxable Funds, In General

Investing money outside of retirement accounts is a bit different because every sale is a taxable event that must be reported to the IRS come tax time. Brokerage accounts create interest, dividends and capital gains. If investors don’t manage the tax aspect of their portfolio, inefficient trading can create a “tax drag” that eats into overall returns.

This is why many investors preach the “buy and hold” strategy as it results in few sales (taxable events).

Other than being mindful of taxes, the same general investment principles apply:

1. Understand your risk tolerance

2. Understand your time horizon (when you’ll spend this money)

From there, just built out a diversified portfolio of low cost, tax efficient holdings.

Then there the only two things I recommend changing when it comes to taxable vs. nontaxable accounts:

1. For equities, use a strategy that consistently captures tax losses

2. For fixed income, incorporate some municipal bonds (tax free interest—not discussed here)

The Basics of Tax Loss Harvesting

Tax loss harvesting, at its core, is looking at all portfolio positions at some point during the year (usually the end), and selling the “losers.”

With sale proceeds, investors can either reinvest the funds in a SIMILAR (but not the same) security to maintain market exposure (you’d hate to be in cash if the market pops), or simply wait thirty days and repurchase the same stock, mutual fund or ETF.

If the investor repurchases the security in less than thirty days after the sale/tax-loss, the IRS will disallow the prior loss under the so called “wash sale” rule. Just know that if you sell a position for a loss, you can’t claim the loss if you buy the position back within thirty days.

Tax loss selling is a familiar concept for many people. With this strategy it’s possible to have an overall economic gain while showing a capital loss for tax purposes. Here’s an example:

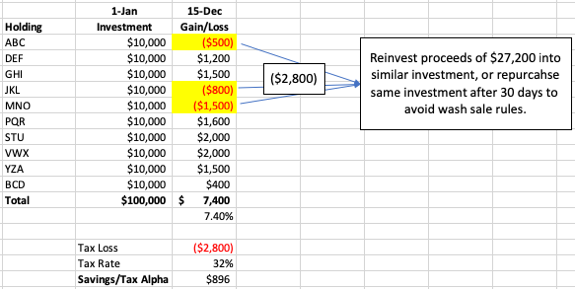

Suppose on January 1stsomeone invests $100,000 into ten securities evenly at $10,000 each. At the end of the year (12/15) seven positions are showing gains and three are showing losses. The cumulative gain on the account is $7,400, or 7.4%.

However, if we sell every loss position, we generate a tax loss of $2,800. The proceeds of $27,200 are immediately reinvested in similar positions to maintain market exposure, but in capturing a tax loss at a federal rate of 32%, we’ve saved $896 in taxes. Here’s the visual:

Economic Return: 7.4%

Tax Loss: -2.8%

After Tax Return: 8.3%

Tax Alpha: $896 (0.9%)

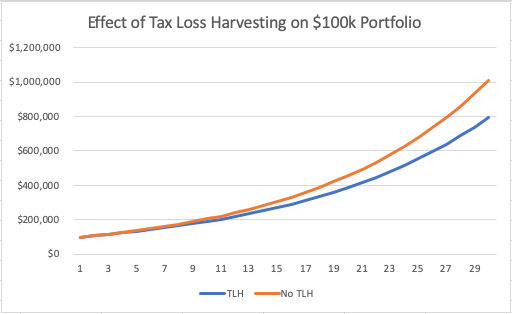

Ok. Alpha of 0.9% might not blow you away, but small consistent positive changes create huge value over long periods of time. Over the course of twenty or thirty years, the consistent tax loss harvesting strategy can create impressive results. Even .9% every year over thirty years, cumulatively, improves a portfolio by 27%. Here’s a graph showing the above return profile for thirty years to illustrate the benefit of tax loss harvesting.

Some years will have better opportunities for tax loss harvesting than others.

The Hard Part? Execution.

Like many brilliant ideas, tax loss harvesting lacks value without proper execution. Many advisors (robo and human) will preach the value of tax loss harvesting but fail to deliver. They get busy, squeamish, whatever. Last year a major roboadvisor, Wealthfront, was fined for botching this strategy.

Also, for folks with only a few positions in the account there may not be great tax loss selling opportunities (in other words, this isn't available to everyone).

Tax loss selling is something that everyone needs to incorporate in an investment strategy for nonretirement accounts. Are you?

Like many things, this just takes a bit of time, work and diligence. It’s “easy money” that will create value over time.

In the next piece I’ll delve down into a more thorough quantitative strategy for folks with more than, say, $100k to invest.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab