One Fund for Equities. A Viable Approach?

A few months back I listened to very popular podcast for financial advisors

A few months back I listened to a very popular podcast for financial advisors. The guest was an advisor that experienced great success at a young age as a traditional Wall Street broker but had since moved into the fiduciary world (the better world of wealth management). After decades of advising thousands of clients, he made a comment that greatly resonated with me regarding investment choices.

He said that with less than $500k in equity exposure, folks should just buy Vanguard’s Total World Stock ETF for equity exposure.

From the podcast transcript:

And with these younger people, I’m always like, “Hey listen, just go to Vanguard, buy this thing, the VT, for the next $250,000. And when you get there, call me.” Now, little do they know I’ll just keep saying, “Well, do that again until you get to half a million then call me.”

This advisor only works with clients with greater than $500k to invest, so this recommendation was within that context (ie. don’t call me until you have $500k). But hearing this from an industry veteran that has made a lifelong living of being the “investment guy” for many wealthy clients was intriguing.

VT is available to virtually anyone seeking to invest. Just a simple all-world equity ETF with an extremely low 9bps expense ratio (.09%). Not an exclusive hedge fund, separately managed account, private investment vehicle or hot mutual fund. This might be the most pedestrian way to gain worldwide equity exposure.

And here is a successful private wealth industry veteran advising that anyone with less than $500k buy into it, above all the other high-fee, alpha-eating, stock picking, market timing, underperforming equity strategies.

I tend to agree with this advisor’s reasoning, and here I’ll make the case to be even more extreme with it.

This advisor’s “one fund” approach brought me back to a Dimensional Fund Advisors (DFA) conference that I attended back in 2016. DFA is a mutual fund company that has grown in popularity with many advisors over the past few years. They have a passive investment approach based in academia with a proved track record back to the early 1980s. They offer investment strategies in nearly every asset class.

One of the presenters was discussing the multitude of DFA investment strategies—large cap, small cap, foreign, emerging markets, etc. Towards the end of his presentation, he referenced that some advisors actually use one strategy for all their equity exposure.

That is, rather than picking and choosing various DFA or other funds to complete their “investment model”, some advisors buy a fund like DGEIX—which offers worldwide equity exposure in one holding.

This, again, is blasphemy to many advisors. I can imagine the horror on an experienced stock picker’s face when they hear that someone just purchases one mutual fund.

- What are they doing for you?

- Could you just do that yourself?

- Why would you pay them for that?

Before we get into the potential downsides of the “one fund” strategy, let’s think about the guaranteed benefits.

- Automatic Rebalancing: You never have to worry about style drift in your portfolio because rebalancing is delivered at the fund level.

- Lower Trading Costs: With no reason to buy and sell among equity asset classes, there are no period trading costs. Some equity strategies use ten of fifteen funds, all of which require a small trading fee.

- Easy Monitoring: With a complex multi-fund investment strategy it becomes about “managing your managers.” The constant monitoring of multiple strategies and fund companies can be a source for error that is avoided with the one fund strategy.

- How is each fund doing vs. the benchmark?

- What changes are happening at the fund company? Is the portfolio manager sick or getting a divorce?

- What are the capital gains distributions?

And what are the downsides?

- No or Low Alpha: With this strategy, you can expect market-type or benchmark-type returns. But as I’ve preached in several other pieces

- Very few people ever achieve long-term alpha, but many will shoot themselves in the foot trying to do so

- So long as saving and spending is in check, all financial goals can be met with market level returns—focus on the “non-investment” items of your plan.

Other than that, I don’t see any real downsides to this strategy. Sure, having all of one’s equity exposure in one fund can present some hypothetical issues—fund company risk, manager risk, etc. But fund level risk is more likely to occur when the fund’s entire value is not some portfolio manager’s alpha generating secret sauce that, when exhausted, could create a NAV-crushing run on the fund.

That sort of thing is less likely with a boring, diversified, index-tracking investment like the one that I would suggest.

Ok..But What About Performance?

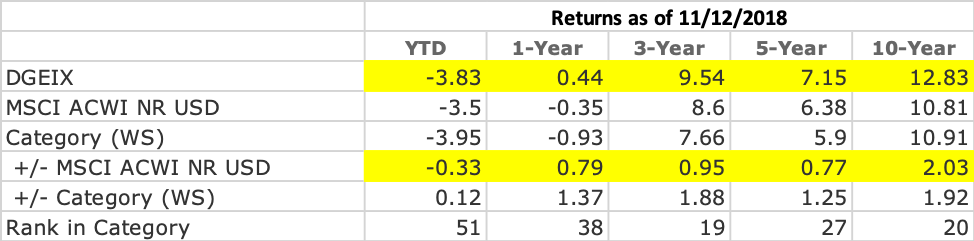

Ultimately, this is what counts. Well, here it is, the YTD 1, 3, 5, and 10-year returns for one-holding global equity strategy as of November 2018.

Out of 362 “World Stock” funds, this fund was ranked 20th. Over ten years, it beat the benchmark by more than 2%.

While “beating the benchmark” isn’t the goal, per se, it’s nice when it happens.

In other words, for the last ten years, you could have purchased one fund and earned attractive returns with:

- Low trading fees: One purchase

- Competitive fund-level fees: .30bps expense ratio

- No rebalancing needs

- Competitive Performance: 12+% per year net of all fees

Is this the true “set it and forget it” investment approach? It removes many behavioral obstacles.

Now think about this: How many folks with less than $500k to invest in equities are pitched by a financial advisor about “beating the market”?

The process of “beating the market” involves endless research, talking to fund managers, trying to pick the right funds or stocks, buying and selling investments at the right time, keeping the portfolio in balance, and managing behavior.

While many believe this is what they “pay” their advisor for, there is little value proposition in trying to “beat the market.”

A busy investment advisor that constantly evaluates the best “managers” (read: Mutual Funds), should prove that their work (and your associated costs) yields intrinsic value by way of performance. Many do this, in my opinion, to “look busy”, but don’t beat VT or DGEIX on a risk-adjusted basis.

If you have less than $500k to invest in equities—why go through the work and hassle of trying to predict the market? Just focus on what you can control (things outside of investment returns)—and let the investments take care of themselves.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab