Don't Buy Whole Life Insurance

“Insurance is never bought, and always sold.”

Let’s be honest, insurance professionals have a tough reputation. Everyone gets a call from an insurance salesperson. It's their friend, or friend’s brother, or friend’s brother’s college roommate, or whoever.

All of a sudden, this guy that you met once ten years ago is calling to meet and talk about your finances.

He’s a nice enough guy, you think, so why not hear what he has to say? During the meeting, he begins discussing the benefits of a whole life insurance policy.

“It accumulates a cash value that grows tax free.” (It’s an investment!)

“Your family is protected in case something happens to you.” (It’s insurance!)

“You can borrow against it.” (It’s a source of liquidity!)

“It’s a long-term savings vehicle with tax benefits.” (It’s a forced savings account!)

After a very long presentation, perhaps with a more senior salesperson, they attract you to a few key figures that seem pretty good (although you don’t TOTALLY understand it…).

“Hey, why not?”

A few years go by, then a few more. Statements come each month like so many other banks or checking accounts. You wonder why you don’t hear from that guy anymore—he has since left for another firm, job, or totally different career.

When it comes time to sit down and actually put a financial plan together, you wonder “What is this thing and why did I ever buy it?”

Unfortunately, this is the case for many young, working Americans that buy confusing insurance policies with high fees and little benefit compared to other, simpler options.

Stepping Back…What Is Life Insurance and Why Is It Necessary?

Life insurance is a risk management tool where you pay an annual premium to an insurance company and, if you die, the insurance company agrees to pay a lump sum to your beneficiaries.

Life insurance is necessary for income replacement. Namely, to protect the income that you would earn for your family while you’re alive. Without YOU, there is no income until age 65 or so. Without your income until age 65 or so, there is very little financial wellness for your family.

A forty-something high earner with three kids needs to make sure that their family will be financially stable in event of an untimely death and loss of future earnings.

But notice the two necessary factors here: (1) there needs to be income and (2) there needs to be a spouse or family relying on that income.

If one of those things is not present, there is no need for life insurance. So, twenty-seven-year-old unmarried lawyers don’t need life insurance. Neither do retirees with large families.

There are times when life insurance makes sense for business owners and those with large estates, but that isn’t what I’m talking about here. I’m talking about the purchase of whole life insurance by young folks with young families.

Insurance for Insurance, Investment for Investment

Once you have financial dependents like a stay-at-home spouse or children, you should add insurance to provide financial stability. To meet this end, just buy cheap term life insurance that takes you through age 65 or so. If you need more later, you can always buy it.

Whole life insurance tries to be something it’s not—an investment. It’s often marketed (as I mentioned above) as some sort of financial Swiss Army knife with a bunch of bells and whistles to give you a tool for life.

In reality, the insurance company wants your monthly premiums. They take that money, invest it, charge a bunch of fees, and give you part of the return. When comparing whole life vs. term, consider this example.

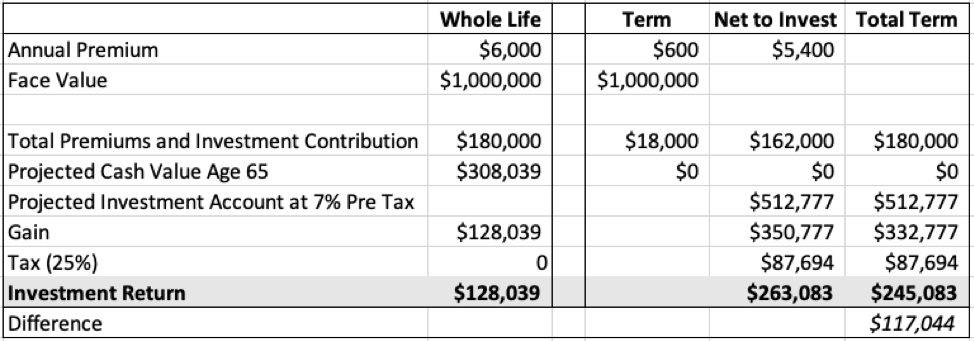

Suppose a 35-year-old married professional with one child is deciding between two options. Option one is a $1mm indexed universal whole life (IUL) policy with an annual premium of $6,000 and the cash value has exposure to the S&P 500. This is based on a real illustration.

The other option is a 30-year term for $600 per year, with an additional $5,400 invested in a simple ETF equity account seeking a 30-year average compounding return of 7%.

The thinking here is that the premium savings ($6,000 whole life vs. $600 term) of $5,400 is just invested for long-term goals.

Here’s the key question: What is the total after tax investment return after we’ve insured our young parent for $1 million during their working years?

Here are the numbers....

Surprise surprise, it’s not close. The simple term plus ETF account nets an additional $117k after tax. Even better, if that annual investment of $5,400 were to a Roth, there is no tax—ever.

Whole life insurance is not a good investment.

Going back to our “Swiss Army Knife” analogy, here’s the reality.

“It accumulates a cash value that grows tax free.” (We invest your money, fee it, and keep most of the proceeds)

“Your family is protected in case something happens to you.” (It’s insurance...same as term for 10x the cost)

“You can borrow against it.” (Non-deductible interest of 8%...no thanks)

“It’s a long-term savings vehicle with tax benefits.” (I can save on my own...)

There is no financial product that can be everything to everyone, although whole life insurance continues to try.

If your cousin’s boyfriend won’t stop hassling you for a meeting, just politely decline and start saving your money on your own terms.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab