Ditch the Retirement Projection For A Five Year Cash Flow Schedule

When I first sit down with clients, I often hear the same questions:

“Do you think we’re doing OK?

“Are we saving enough?”

“Do you think we’re on track for retirement?”

“How much more do we need to save for retirement?"

It’s really hard to give a worthwhile answer to these questions with any certainty because retirement projections have limitations.

First, retirement projections are based on assumptions, and those assumptions are based on information as we know it today. Everything can change in the time between “today” and “retirement”. Life, law and markets could all change in ways that we can’t even conceive. There are assumptions about markets that have all sorts of biases and flaws, and tax assumptions are based on today’s tax code, which is always subject to change. And what about events totally outside our control like geopolitical or environmental catastrophes?

Do you think that retirement projections from the early 1980s accurately accounted for the 1987 stock market crash, the tech bubble, 9/11, the great recession, the current bull market, or insanely low interest rates? Reading financial assumptions from thirty years ago is like reading a 1950s article that predicts floating houses and flying cars by 2020, or earlier.

Second, while retirement projections are useful for spotting major red flags (they will show if a retirement is severely underfunded), they do not provide meaningful short-term action steps. Long-term thinking is good (and necessary), but any major endeavor like retirement should be broken into small, manageable chunks.

That’s why I always direct clients and prospects toward the same process: Building out the five-year cash flow savings schedule.

Positive cash flow is the cornerstone of financial health, and younger clients, once established in their careers, generally have significant savings potential.

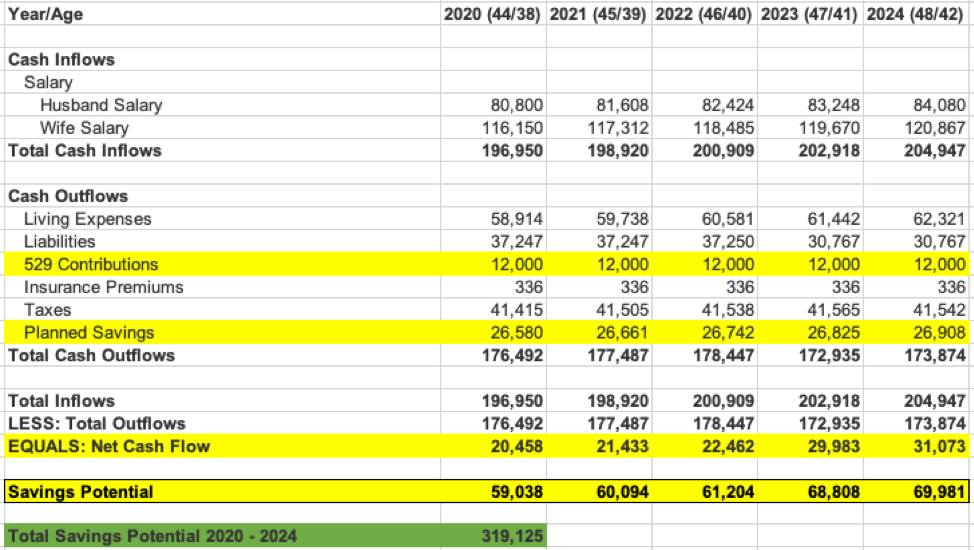

We start by building out all the traditional items of a household cash flow statement with the goals of determining how much the clients can save in the next five years.

Beginning with gross income and living expenses, we then add in taxes, capital expenditures (usually home projects), major outflows (weddings, college, etc.), and planned investments (401k, etc.)—all with the goal of estimating a family’s savings potential over the coming five years.

Just building this takes a lot of work. We go through budgets, payroll statements, tax returns, and benefits packages to build a “current” schedule.

After this, I’ll go through everything to find planning opportunities to save on taxes, benefits, or make expenses more efficient.

It’s actually amazing how just a few tweaks can create major differences over five years. For high-earning clients, this is really just making sure that they:

(1) max out available retirement accounts, (401k, SEP-IRA, etc.)

(2) max out all other tax deferred accounts (FSA/HSA/ etc.)

(3) shop around for lower property insurance premiums

(4) clean up the budget for outdated subscription fees

The difference is often thousands of dollars, but the real value of this process is that clients understand how funds flow through their household, and how their situation might change over five years if they stay the course. It forces people to be aware and intentional about spending and savings.

Of course, any time there is a major financial transition or liquidity event—tax planning becomes a big source of savings.

As I’ve mentioned in other articles, the basic wealth equation is just saving as much as possible, investing the savings towards goals, and keeping the savings invested and protected from bad emotional mistakes.

This all starts with a five-year cash flow schedule. Here’s a picture of one:

Each line item has growth rate assumptions built in. For example, there are conservative estimates for salary raises, and living expenses growth with inflation. The purpose is to understand what a family can expect to save over the next five years, which can be encouraging.

It's like a business plan for your family.

If you think this would be helpful for you, shoot me a note today.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab