Locate Risk into Retirement Accounts ? The Value of Asset Location

Asset allocation is big theme in today’s investing landscape.

Hedge fund managers and “DIY” investors alike understand the importance of asset allocation—namely that by owning multiple asset classes, investors can reduce risk without reducing expected returns. Sustainable risk-adjusted returns are a necessary component of any disciplined portfolio.

We often hear about tax loss harvesting, but for most investors with only a handful of taxable holdings, there is little to gain in selling for losses at year end.

But there is very little discussion regarding another necessary characteristic of an all-weather, long-term retirement portfolio: the location of assets over account types with various tax treatments. This process involves placing tax-inefficient assets in tax-friendly accounts, and tax-efficient assets in taxable accounts. By optimizing asset locations, investors can reduce taxes which, over the long-term, can provide a significant boost for investment returns.

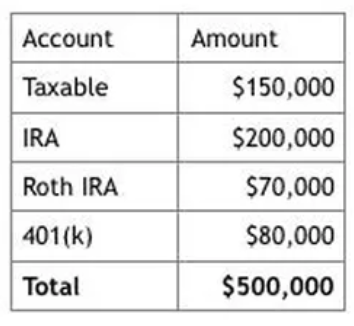

Asset location requires developing a household-level investment plan where all assets for an individual and/or couple are considered in the portfolio design. If a household with a 70/30 equity/fixed income allocation has $500k spread across one taxable account, two traditional IRAs, and two Roth IRAs - we wouldn’t simply set each account to 70/30. Instead, would look at the entire household portfolio to determine which account(s) should hold which asset classes to maximize tax efficiencies and optimize the return on investments.

An example of a tax-inefficient asset is a “REIT” (Real Estate Investment Trust) which, by law, must pay out 90% of all income to the shareholders. Each year, investors receive taxable income, and rather than reinvest and compound that income, investors must pay taxes annually. If a REIT pays out $5,000 in income and an investor with a 40% tax rate has to pay $2,000 to Uncle Sam, that only leaves $3,000 available for reinvestment.

Other tax-inefficient assets include high yielding taxable and/or interest-bearing securities (I.e. corporate bonds and preferred stocks), or managed portfolios with a significant turnover that generates capital gains (I.e. many actively managed stock portfolios).

Tax-efficient investments are those that either pay tax-exempt income (I.e. municipal and government bonds), or equities if they are managed in a low-turnover or buy-and-hold strategy, (common for certain classes such as U.S. large-cap).

In general, large-cap strategies are more tax-efficient than small and mid-sized strategies, and index funds (passive investments) are more tax-efficient than actively managed mutual funds.

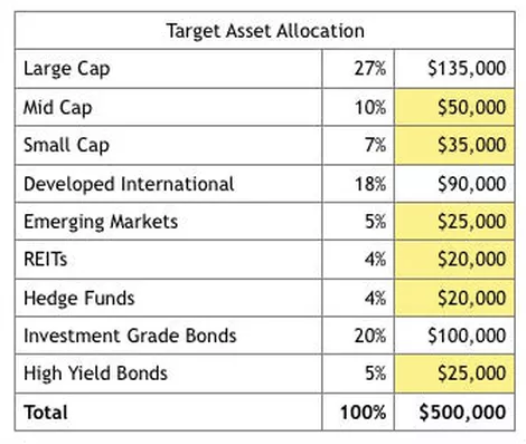

With that in mind, here’s an example of the strategy using our hypothetical household with $500k seeking an allocation of 67% stocks, 25% bonds and 8% alternatives.

The cells highlighted in yellow are the potentially tax-inefficient asset classes that should be placed in tax-deferred or tax-free accounts. The total value of these tax-inefficient assets is $175k. Keep in mind that these investment classes are inefficient for different reasons.

High Yield Bonds and REITs provide high current income, where Mid-Cap, Small-Cap and Emerging Market equities are more likely to be actively traded with higher capital gains. Hedge Funds can be either high-income or high-turnover and often come with tax compliance burdens (your tax return is more complex and more expensive), which is where it becomes even more important to hold these investments within an IRA or tax-deferred account.

The concept of strategic asset placement is fairly easy to understand, but there are some operational roadblocks and concerns that we should discuss when it comes to implementation and maintenance.

1. There Is No Perfect Fit— Prioritize Tax-Inefficient Assets First. With multiple asset classes and accounts, it will always be the case that exposure to certain asset classes will be spread throughout accounts. The goal is to isolate and allocate those assets with the lowest tax efficiency first, and then work with the other more flexible assets. This also means there will be “odds and ends” where you have to allocate small amounts of unused funds to round out the asset allocations. It seems inefficient, but it makes sense when considering the bigger picture.

2. Rebalancing Presents Challenges— Keep Things as Flexible as Possible. Despite a more efficient initial design, portfolios optimized for asset location prove harder to rebalance because you cannot move the assets freely between accounts. There are limits on contributions and distributions which can trigger serious tax consequences and undermine the entire structure. For that reason, we need multiple asset classes within each account to allow for rebalancing as needed. Also, the major asset classes (Large-Cap, International, Investment Grade Debt, etc.) should be close to each other as they are often rebalanced together.

3. Account Usage Matters. Individuals will always keep a closer eye on taxable accounts—it’s just more important to them than the money they cannot touch without penalty until they turn 59 ½. With that in mind, keep taxable accounts liquid and, to the extent you are able, as “vanilla” as possible. Large-Cap equities and Investment Grade Debt are good uses of taxable funds. Likewise, 401(k) plans which receive the heaviest contributions will provide more options for rebalancing.

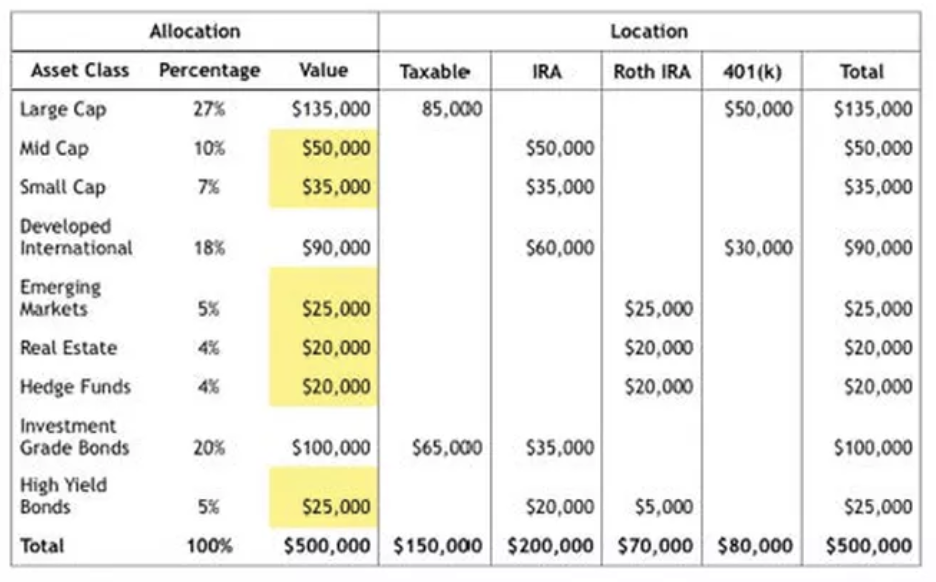

With that in mind, here is how I would structure and optimize the portfolio through asset location:

Let’s go account by account to examine the thought process behind this design:

1. Roth IRA. As the most tax-favorable account, the Roth IRA should hold the least tax-efficient assets. By placing REITs (high current income), Hedge Funds (tax nightmare) and actively-traded equities into the Roth, we eliminated the tax concerns associated with these asset classes. Dividends can be reinvested, there are no headaches for CPAs, and long-term growth assets (such as Emerging Market Equities) can grow tax-free. After accounting for those assets, the Roth IRA still has $5k leftover, and ultimately this “odds and ends” amount gets allocated to round out the High Yield Bonds—another investment with unfavorable taxes.

2. 401(k). My thinking here was that in general, 401(k)s can be relatively limited as far as the investment choices available to investors, but usually, they have ample options for “marquee” asset classes such as Large Cap and International Equity. By allocating the entire 401k to these two asset classes, we can also: (1) use this account for tax-free Large Cap/International rebalancing; and (2) benefit from annual contributions. This is not a professionally managed account, so this structure also makes it simpler for the investor/employee 401k holder to execute on their own.

3. IRA. This is a large, tax-deferred and (likely) a professionally managed account. As such, the IRA holds the most classes of equity. Note that this account holds roughly a third of all Investment Grade debt, an asset class with varying degrees of tax-efficiency. In placing a portion of Investment Grade Debt in a tax-deferred account we can seek higher income without concern for tax consequences.

4. Taxable Investment Account. The taxable account has a similar debt/equity allocation as the overall portfolio but holds only Large-Cap Equity and Investment Grade Debt. Index funds and ETFs will provide the Large-Cap exposure (or individual securities for larger accounts where tax loss harvesting makes sense), and we use Investment Grade Debt, Municipal Bonds (Federal and State tax-exempt), Treasury Bonds, and Short Duration (low-volatility) Bonds, for the debt exposure. With portions of manageable equity and tax-favored lower-risk bonds, this account provides long-term growth along with the necessary liquidity.

Conclusion

Asset allocation analysis is not necessary for every instance, but it should be a consideration in the construction of your overall investment portfolio. It may not be as smooth or easy to build and maintain, but minimizing taxes over time can be a significant driver of long-term portfolio returns. This concept which is often referred to as “Tax Alpha” is also a big part of “Advisor Alpha,” which represents the additional benefits achieved by working with a professional advisor.

So - if your Financial Advisor hasn’t considered asset location when constructing a balanced portfolio, ask them about it. It will be worth the extra effort in the long run.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab