Moving to the Burbs to Start a Family? Keep Your City Condo as a Rental

The real estate market in coastal cities is booming.

The real estate market in coastal cities is booming. Here in Boston, property values and rents have skyrocketed since the Great Recession and there are similar trends in other large metropolitan areas. Many young people that purchased in the “right neighborhoods” have significant equity in their homes.

For those young families seeking a sprawling suburban home, it seems reasonable to sell the city condo at a massive gain and roll the equity into a down payment on a larger family home. But is that the best strategy?

Before listing the condo and cashing in on the red-hot sales market, young urbanites should review all their options to make sure that selling is the best strategy for long-term wealth.

Consider this: Real estate has created more American millionaires than any other profession or endeavor, and for good reason. For those of us without full-time real estate careers, or the time to find and vet direct real estate investments, the “keep your condo” strategy is a way for people to tap into a “trifecta” of wealth building that long-term real estate investments can offer.

A proper real estate investment can provide three advantages:

- Tax-Advantaged Current Income: A good rental can produce a positive monthly cash flow that is often shielded from taxes through depreciation and other deductions.

- Long-Term Appreciation: The potential to continue to build equity as renters pay your mortgage while the property value appreciates over time.

- Liquidity: If the property appreciates and rents increase, investors may be able to borrow against their properties to fund major life expenses in a relatively safe, sustainable, and tax efficient manner.

Very few investments can offer the potential to achieve positive cash flow, long-term growth, tax advantages and hassle-free liquidity. In the article below I’ll outline a common scenario and explain why this strategy can work. I will then cover some of the common objections and/or hurdles.

First, an example.

Let’s assume that five years ago, a young couple with a combined annual income of $150,000 bought a two-bedroom condo in Boston for $350,000, with a mortgage of $300,000 at 3.75%. Now, the couple has a baby and needs more space in the suburbs. They’re making more money, about $200,000 combined, and based on comparable properties, their condo is now worth $600,000 and would rent for around $3,300 per month (again, these numbers are based on real stories). In five years, they’ve paid principal down to $269k, and have $330k in home equity ($600k value less $270k mortgage).

If they sell, they can walk away with most of that cash. Sounds great, but the real question is whether they can find a better way to allocate some their $330k of equity to meet short and long-term goals.

Let’s first look at the conventional strategy: Sell the condo, buy in the suburbs and invest the difference

- $330k, less 5% broker’s commission ($30k) nets to $300k—all tax-free

- Assume $125k will be used for a down payment on a new home worth $550k with a 30 year $425k fixed-rate mortgage at 3.75%

- The rest ($175k) will be invested in low-cost index funds along a 70/30 equity/fixed income allocation that we will assume grows annually before taxes at 7%

Assuming a modest 3% growth rate on real estate, after ten years of investment growth and paying down the new mortgage, the couple’s balance sheet would look something like this:

Now let’s analyze the real estate investment: The cash-out refinance strategy

If the couple needs cash for a down payment on their new home, they don’t need to sell the condo. They can refinance the loan at a higher appraised value, take some cash out, and let tenants pay the mortgage.

Assume rather than selling, they refinance the condo with a new mortgage of $394k ($269k existing mortgage plus $125k), effectively “pulling” the new down payment out of their home in the form of a 30 year fixed rate mortgage at 3.75%.

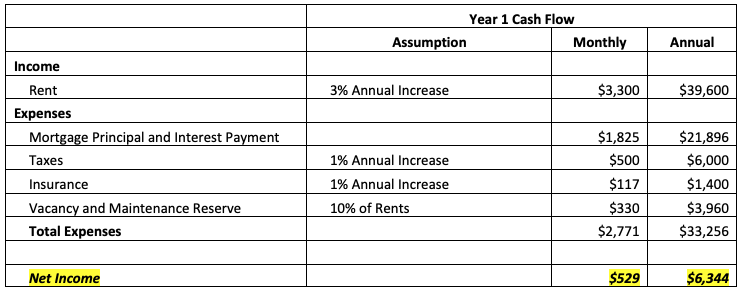

The numbers work—after the refinance the property cash flows at $6,344 per year. The couple now owns a home in the suburbs and a cash-flowing real estate income property.

Advantage One: Positive Tax-Preferred Monthly Cash Flow

Who couldn’t use an extra $6,344 per year?

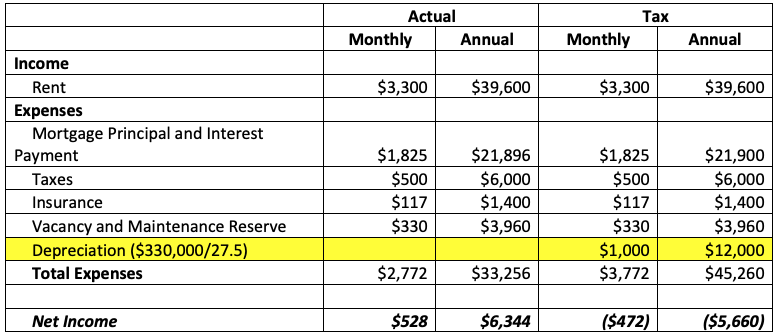

But it gets better because none of that money is taxable in the first year. The property actually has a net taxable loss due to the concept of depreciation (another much-beloved tax benefit of real estate investors that I won’t bore you with). Here’s the comparison of actual vs. tax cash flow for year one.

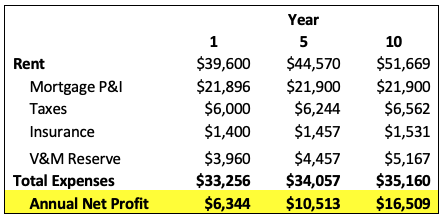

Here are the annual cash flow numbers for years 1, 5 and 10 using the same income and expense growth rate assumptions shown in the table above.

The cumulative profit after ten years, before any investment, is $112k. These funds could be allocated towards any financial goal—long-term investment, fun, college savings—you name it.

Advantage Two: Long-Term Wealth

You’re now building equity in two ways: (1) Renters are paying down the mortgage and (2) the property appreciates.

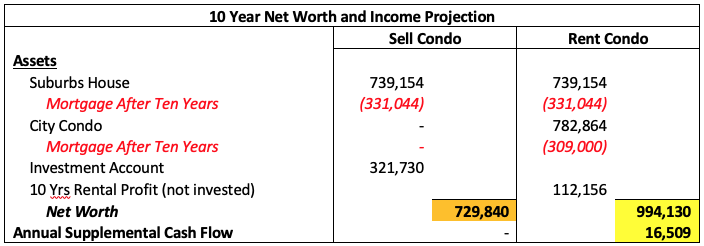

After ten years of payments, the note principal will be down to about $309k. As this happens, the property continues to appreciate at a modest 3% annually, for a value after ten years of $783k. That means total equity in the rental property is now about $474k. Here is a net worth comparison after ten years.

There is no question that the couple is better off financially in the “keep your condo” strategy. Even assuming zero investment growth on the cumulative rental profits, the couple has an additional $265k ($994k - $729k) in net worth and $16.5k in income.

The numbers speak for themselves. And this is only after ten years.

Advantage Three: Tax-Free Liquidity

Access to funds is an important piece of financial planning. You can’t spend money if you can’t access it. While the liquidity of financial assets is alluring, there are serious tax consequences when selling appreciated stocks in a time of need. Unloading ten or more years’ worth capital gains to pay for an emergency expense can be a very painful experience.

In contrast, borrowing against cash flowing real estate for liquidity can help avoid taxes and preserve expenses with virtually no out of pocket expense.

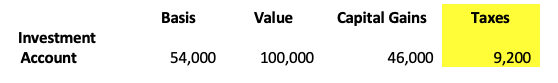

By way of example let’s assume our young couple needs $100,000 dollars ten years after buying their suburban home. If they sold their condo they would look to their investment account for funds. In year ten, the investment account is $321k, with a taxable basis of $175k. That means about 46% of every dollar is considered a long-term capital gain, taxable at a combined federal and state rate of 20%. In other words, accessing $100k would generate about $9,200 in taxes.

No one likes writing a check for $9,200, and the tax numbers worsen as the needed funds increase.

Remember we are assuming that this young couple has been disciplined, long-term investors and hasn’t squandered away proceeds from their condo sale a decade earlier.

But with cash flowing real estate, owners can refinance the property and effectively borrow the $100k with zero taxes, allowing future renters to pay it back over 30 years. While they will forego some annual cash flow as a result of taking a higher mortgage, and pay more interest over time, these are worthwhile tradeoffs considering the cash flow will regenerate and the property will appreciate for years to come.

In other words, long-term buy-and-hold real estate investors aren’t afraid of debt and can use it to their advantage. Many real estate investors borrow against their properties to pay for college, weddings or medical emergencies with no out of pocket cost.

“If It Were Easy, Everyone Would Do It”: Pitfalls and Common Objections

So why doesn’t everyone do this? It’s certainly not for everyone and there are some roadblocks. First, there may be real estate downturns to weather. This strategy also requires investors to become comfortable with (and qualify for) significant amounts of debt. Second, you have to be a landlord, and this comes with its own set of operational headaches. I’ll address these issues below.

Popular Objection 1: “What happens if the real estate market drops?”

As long as it makes money, you should keep the property and not worry about any temporary downturn in the market. You don’t lose money until you sell, and what would force a sale is negative cash flow, not a drop in value. If after ten years the property has dropped in value to $550k, and the rent covers all expenses, we don’t care about property value.

The initial equity is the buffer against a market downturn. In fact, many long-term real estate investors don’t mind having property “underwater” (where the loan exceeds the value) if it continues to cash flow each month. Like any other long-term investment, you have to ride out the downturns.

Popular Objection 2: “I don’t want to be a landlord.”

Nobody wants to get the call at 2 am on Christmas about a toilet overflowing during a snowstorm. That’s what everyone is afraid of. While the horrible inconvenience is a possibility, land lording can be an efficient and “hands-off” process after some initial work. Hopefully, you can establish a helpful team that will handle these issues so you don’t have to. It may take a few years, but it can be done. Keep the long game in mind, and don’t give away a goldmine because you may have to pay a security guard $15 per hour to occasionally guard it.

For every toilet nightmare mentioned above, there are dozens of successful “hands off” landlords that experience success renting to long-term, professional tenants. Put the time into managing the property efficiently.

Now that we’ve dealt with the two most common objections to buy and hold real estate investing, here are some legitimate risks that could undermine success.

Legitimate Risk 1: The Rental Market Subsides

Without quality tenants, none of this works. If there is a prolonged vacancy or tenant in default that required the costly and time-consuming legal process of eviction, this investment could turn sour very fast.

In more stable rental markets like New York and Boston, which both experiences increased rents throughout prior recessions, this is an ideal strategy and preferably the young urbanite condo is located in a top-tier location servicing top-tier tenants (professionals, graduate students, etc.).

In other words, there are some baseline rental assumptions that would not be present in more volatile real estate markets servicing a lower-tier tenant.

Legitimate Risk 2: Be Comfortable, and Responsible, with Debt

Debt is like fire. Although inherently dangerous, if managed properly and utilized responsibly, it can significantly improve our lives. If accessed without care for the future or full comprehension of risk, it can ruin everything.

There is a lot of debt involved in this strategy in that it requires multiple mortgages and refinances. That alone may exclude borrowers without sufficient credit or income to meet lending requirements. But for those with strong credit and enough income to make the strategy work, I wouldn’t be discouraged by the debt in and of itself.

There is a lot of really bad debt, but a fixed rate 30-year term mortgage is a very good debt. First, the interest rates are very favorable, usually below 5%. Compared to credit cards (16+%) and student loans (5+%), it looks great. Second, unlike other types of debt, the interest on mortgage debt is tax deductible. Third, it’s a fixed, predictable monthly payment that, if affordable, should be very manageable for diligent and responsible borrowers.

Don’t be afraid of debt, just understand the risks.

Conclusion

For young people with highly appreciated properties in desirable areas of major cities, the “Keep your condo” strategy could provide an accelerated wealth building tool and benefits for years to come. So before you sell that condo, be sure to run the numbers!

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab