Why You Should Consider the HDHP/HSA During this Benefits Season

Nobody likes paying high premiums for family health insurance coverage. If premiums seem very high, it’s because they are.

In fact, the cost of family healthcare premiums has increased 55% in the last ten years. What was once a negligible payroll deduction is now a major household expense that could very likely exceed expenses like real estate taxes, car payments or mortgage interest.

But ask yourself—why continue to pay such high premiums if you don’t require significant ongoing health services? Total premiums could be $10,000 per year, but the gross amount of medical care may only be $3,000 - $4,000.

Wouldn’t it be better if you could lower the premiums and just pay for what you need out of pocket with coverage only for low-probability-catastrophic type events?

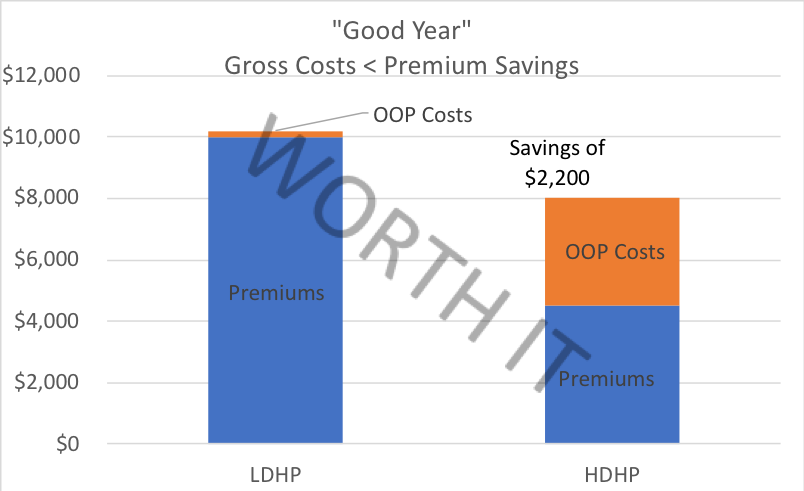

Well, that’s exactly how the HDHP works. Under this plan, your premiums are now $4,500 and you are responsible to cover medical needs up to a $6,000 deductible. With average medical needs of around $3,500—your total average annual cost to insurers and healthcare providers is $8,000—for an annual savings of $2,000.

The key question is this: Does the delta on premium savings exceed the projected cost of medical care during a “normal” year? If so, it likely makes sense to use the HDHP.

Again, this strategy is not useful for folks that require ongoing medical services with gross costs greater than their premium savings (likely $4,000 - $5,000). This is strictly for folks that need nothing more than their normal checkup, a few specialist visits and maybe one or two ER visits.

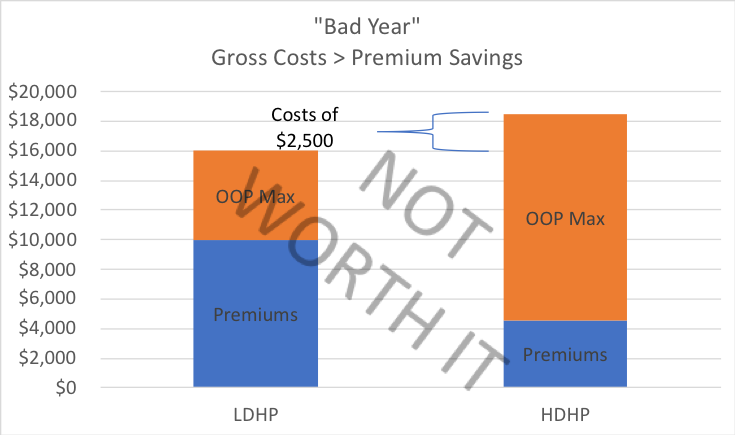

What if you do have major health expenses? Car accident, surgery, etc. In that case, each plan will cover all costs after the out-of-pocket max (OOP max). The OOP max is all costs (deductible, co-pays, and co-insurance) other than premium costs. For families, the OOP max is usually around $6,000 for LDHPs and $12,000 for HDHPs. Here’s how it looks if you’re caught flat-footed in need of major health services with an HDHP, using those numbers.

The HDHP costs an extra $2,200 and was obviously a terrible idea so we shouldn’t even consider it, right?

No.

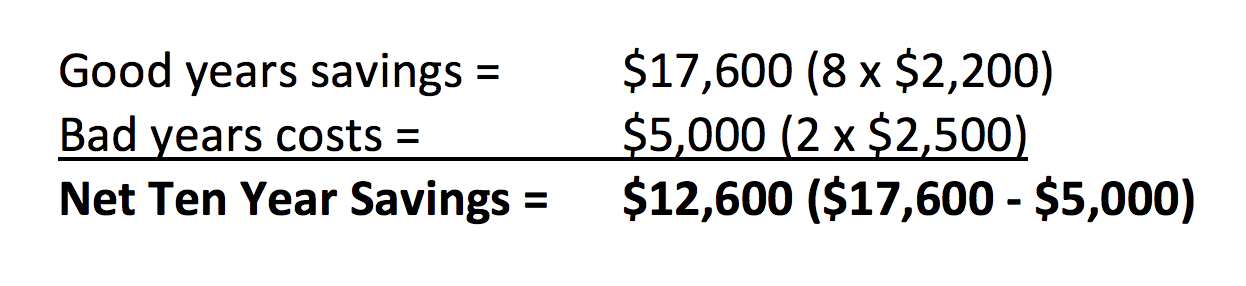

You have to realize that most years will be good years. Yes, maybe once or twice in ten years you’ll be on the wrong side of this, but let’s just consider ten years. If you have two “bad” years in a ten-year span (statistically it should be less than that), this would be a FANTASTIC strategy.

On average you’re saving $1,260 per year or a little over $100 per month.

OTHER CONSIDERATIONS

Become a Smart Healthcare Consumer: Now you will treat healthcare services as an economic decision. Understand which providers offer the best value (competent service at a reasonable price). This is how we evaluate all other economic decisions, right? Gone are the days of disregarding the cost of healthcare.

Stay Healthy! If you’re healthy, you’ll save money. Wear your seatbelt, exercise, eat right, etc. If you don’t, it could you physically and economically.

Part II – Tax Benefits and Long-Term Strategy

The benefits of the HDHP strategy only start with the pure annual savings on medical outflows (premiums + co-pays + deductibles + co-insurance). In practice, folks can establish a health savings account (HSA) to pay for any qualified medical expense, which includes co-pays, deductibles, and co-insurance, among hundreds of other eligible expenses.

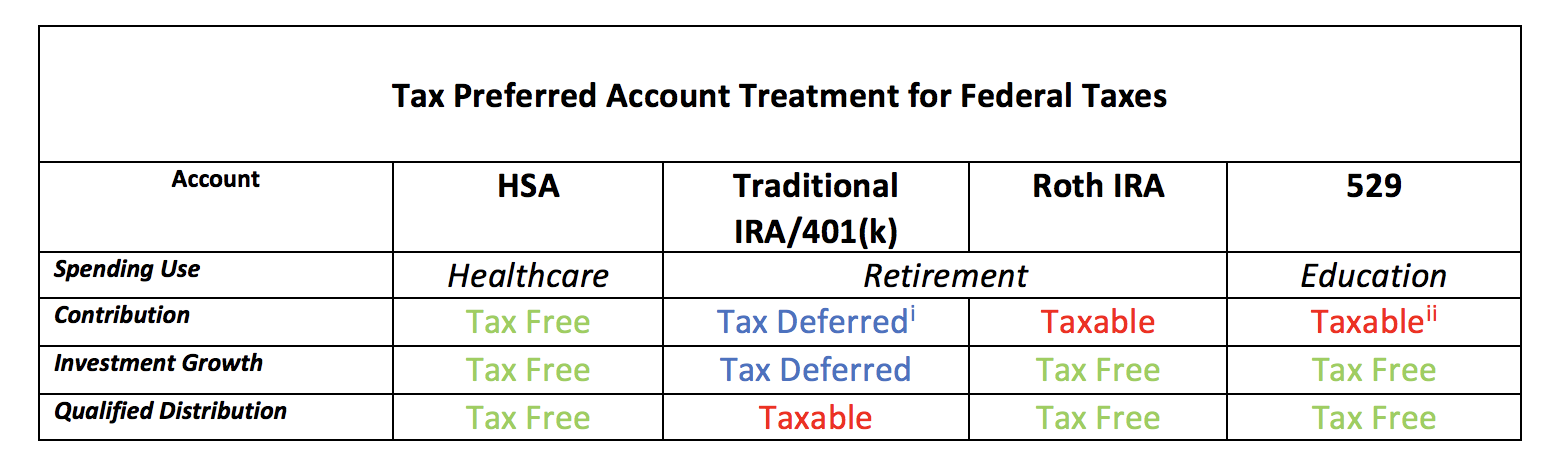

Why is this good? Because the HSA is triple tax-free. Think of the HSA as another tax-preferred account similar to a Roth or traditional IRA/401(k) or 529 college savings account. The government has created an incentive (tax benefits) for you to meet some deemed-worthy goal (retirement, education, healthcare spending). With an account there are three potential taxable transactions:

- Fund the account

- Invest the funds

- Distribute funds for the intended use (retirement, education, healthcare, etc.)

For an HSA, the government has granted the optimal tax treatment in all three possible transactions.

- Fund the account – “Above the line” deduction (the best kind of deduction!)

- Invest the funds – Tax-free investment growth

- Distribute funds – Tax-free for qualified medical expenses

Let’s contrast that with other tax-preferred accounts.

This is why HSA plans are referred to as “triple-tax-free”.

This creates a profound savings opportunity for economic and tax purposes. Generally, there are two sides to every equation—economic (or “book”) and tax. In our previous example, we discussed the pure economics of the HDHP strategy to show there is a pure savings—but how do taxes play into this?

Let’s Back Up A Bit: The Taxation of Healthcare Expenses

Healthcare expenses are divided into two categories – premiums, and everything else. Currently, health insurance premiums are tax-exempt to employees, employers and the self-employed.

Then there is everything else. Co-pays, deductibles, co-insurance, everything else….and here is where it gets interesting. These are technically deductible as “Medical Expenses” on Schedule A, but only to the extent, they exceed 10% of household Adjusted Gross Income (AGI).

That’s a very high bar. Imagine a young couple each earning $75,000 gross salary. After all deductions, they have a combined AGI of $130,000. Unless they have more than $13,000 (10% of AGI) in medical expenses, they have no deduction. The 10% limitation makes the deduction practically impossible for this demographic.

HSA Strategy One: Minimum Annual Contribution to Capture Deduction for OOP Expenses

This strategy works well for folks that are a little tighter month-to-month and only wish to deduct what they’ve actually spent.

We have assumed in the previous article that our young healthy couple using an HDHP has $3,500 in OOP medical expenses.

With an HSA, they could simply:

- Wait until December and tally up all OOP expenses ($3,500)

- Fund an HSA with $3,500

- Immediately distribute the funds to reimburse for qualified medical expenses

That’s it—they’ve now captured that $3,500 as a full “above-the-line” deduction. At a 24% federal tax rate, this amounts to a tax savings of $875. Just “run-it-through” an HSA.

That’s what I would call the “minimum contribution strategy”. This strategy is effective, but certainly not optimized.

HSA Strategy Two: Maximize Contribution for Full Tax Deduction + Savings and Investment Growth

This strategy works well for higher earning folks looking to capture a maximum tax deduction and build a reserve for future OOP medical expenses.

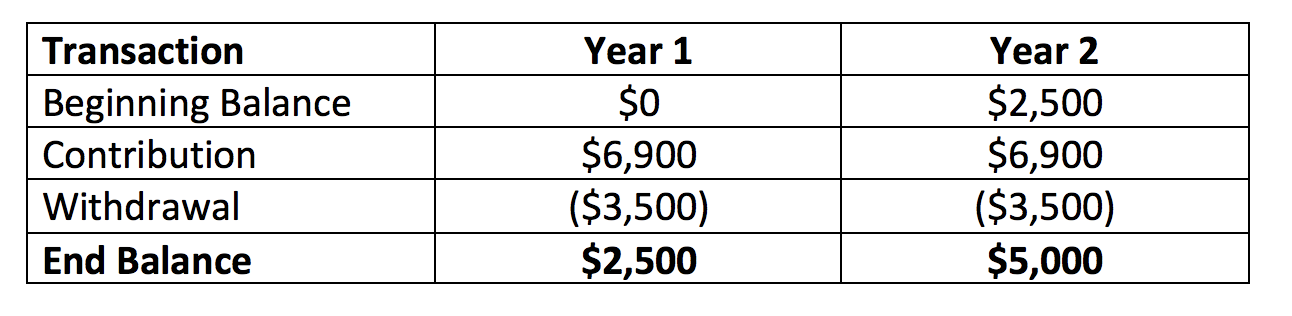

Our married couple is allowed to contribute $6,900 (2018 amount) to an HSA in any calendar year. They receive a full deduction for the contribution regardless of whether they distribute those funds for qualified medical expenses.

This works well for two reasons. First, there are immediate tax savings of $1,656 ($6,900 x 24%)—so that’s nice. Second, our couple can carry over any undistributed funds to the following year. In this case, they would start year two $2,500 in their HSA—and keep building.

It’s easy to see that after a few years of this strategy our couple could save a critical mass of medical expense reserves.

Additionally, the HSA allows for investment with tax-free growth. Once the account his $5,000 or so, it would make sense to invest and start earning on the money. All the while, our couple enjoys an annual $6,900 tax deduction.

But why would you want so much money in an HSA?

First, it’s your Healthcare 401(k). You might not need it now, but as statistics show, healthcare spending in retirement is a horrifying liability. Having tens of thousands (or more) saved in a tax-free account earmarked solely for healthcare allows for more efficient retirement planning.

Second, these aren’t just funds that sit untouched until age 59 like a traditional IRA. You can access these funds throughout your 40s and 50s for any qualified health expense, which is a very broad category.

If your advisor isn’t helping you establish this strategy, schedule a call today.

[i] Income limitation on tax-deductible IRA contributions

[ii] Deductions available in some states, but no Federal deduction

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). Information contained herein is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Information contained herein is taken from sources believed to be reliable, but cannot be guaranteed as to its accuracy. It is for informational and planning purposes. Nothing herein shall be construed as an offer or solicitation to buy or sell any securities. Nor is it legal or accounting advice. Investing carries risks and expenses and involves the potential loss of investment. Past results are not indicative of future results.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab