What To Do With All Those RSUs?

Many employees receive restricted stock units (RSUs) as part of their compensation, but few develop a strategy to incorporate RSUs into their wealth plan.

After working with several RSU grantees, here are some simple answers to the most common question I hear from clients: “What should I do with my RSUs?"

Before we get there, let’s just go over the basic rules of RSUs and how they play out in a wealth plan.

RSUs are a grant of shares of company stock in lieu of cash. From a payroll standpoint, they are treated as cash, with similar withholding requirements and subject to ordinary income tax when received (or “vested”). Here’s an example:

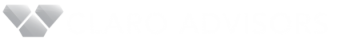

On 1/1/year 1 (the grant date), Steve Salesguy has 5,000 RSUs that will vest in 25% “lots” (1,250 units per lot) starting one year from the grant date. The price on the first vest date (1/1/year2) is $11 per share—for a total net value (after 40% taxes) of $8,250. Steve can sell the shares or keep them.

The same transaction occurs in each of the following three years, with the total value determined solely by stock price on the vesting date.

The obvious question is whether to hold the shares as a longer-term investment, or sell the shares with few tax consequences and use the net funds for other financial goals.

I almost always recommend selling the shares immediately and diversifying the proceeds. RSUs provide access to a steady source of savings for building wealth, and employees shouldn’t leave them exposed for any longer than necessary.

This recommendation always yields another obvious question, “But what if the stock price skyrockets? Aren’t I missing out?”

Yes, but not really. There are still 3,750 shares outstanding that will appreciate if the stock price increases. This strategy provides for downside limits while preserving substantial upside capture.

Additionally, it’s likely that Steve will receive more grants each year, with 5,000 additional shares of upside potential. So it makes sense to take some money off the table. Many employees failed to do this in the 1990s and 2000s and paid dearly when the tech bubble burst.

In the following scenario, I’ll illustrate how the “sell and diversify” strategy can capture upside with less risk on the downside.

To illustrate, let’s assume Steve receives annual grants of 5,000 RSUs on a similar vesting schedule for eight years. Under one scenario - he holds the shares indefinitely, and under the other - he sells shares as they vest and puts the proceeds to work in a diversified portfolio that achieves a 7% average annual return before taxes.

To show the value of my recommendation, we’ll insert one more variable for comparison: in one case - the stock price increases substantially, and in the other - the company tanks in year five and barely recovers (not zero, but a substantial loss).

First, here’s the scenario where the stock continues to rise.

After eight years, Steve has netted 16,500 shares with a total value on the date of next vest of $412,500.

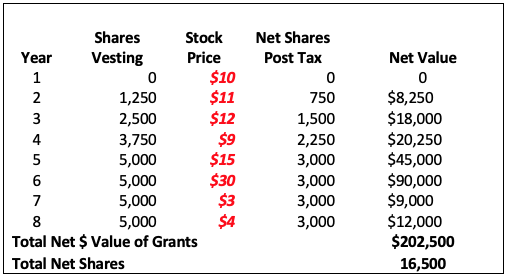

If he held the stock, and all shares were valued at year eight stock price of $40, his position would be worth $660,000.

If, by contrast, each year he invested the net dollar value in a portfolio earning a 7% annual return, he would have about $494k—leaving some $167k on the table. Not ideal, but consider that he (1) has diversified significant risk and (2) continues to have upside potential with all his shares that haven’t yet vested.

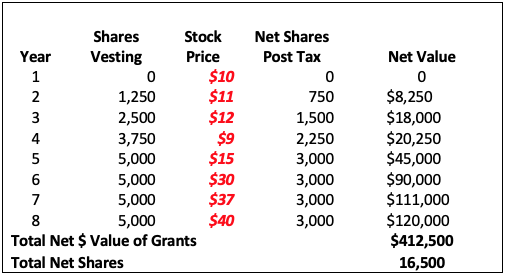

Now here’s the real benefit of diversification for RSUs. What happens if the company tanks?

If we run the same scenario as above, but the stock drops to $3 in year seven and rises to $4 in year eight, Steven will be very happy with his decision to diversify.

If Steve held all the shares, his position would be worth $66,000 (16,500 x $4 stock price). If he diversified all $202,500 of value at each vest and compounded at 7% annually, he would have a portfolio valued at about $261k. That’s a difference of about $195k.

This is the reality for many RSU shareholders as companies continue to rise….until they don’t. The allure of “shooting the lights out” causes many employees to ferret away what would otherwise be substantial annual savings boost and long-term wealth building tool for dreams of “hitting it big” like the janitor from Microsoft. Employees simply don’t comprehend the amount of risk in their portfolios when they remain so exposed to one company.

That’s why I almost always recommend that employees sell and diversify RSUs as they vest.

Here’s a summary of all scenarios to highlight the value of diversifying away from one’s company equity.

There is an exception to every rule.

While I advise diversification in most cases, it might be better to hold in the case of high growth companies that are recently public, or some other situation where growth is reasonably expected.

This example is to show that, even if you miss out on some growth, diversification can help avoid losses, and that matters in the long run.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). Information contained herein is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Information contained herein is taken from sources believed to be reliable, but cannot be guaranteed as to its accuracy. It is for informational and planning purposes. Nothing herein shall be construed as an offer or solicitation to buy or sell any securities. Nor is it legal or accounting advice. Investing carries risks and expenses and involves the potential loss of investment. Past results are not indicative of future results.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab