Tax Loss Harvesting Part II: An Enhanced Strategy For High Earners

Beat the Index With Consistent Tax Alpha Over Time

If you’re a high earner with more than $100,000 to invest in a taxable equity account, I have an idea for you. Consider investing in a tax-loss selling strategy that mirrors a benchmark through holding individual stocks, and consistently selling losses to generate superior post-tax returns.

For most folks, I suggest passive rather than active investment strategies. That means, if given the option, I would choose to own a simple ETF vs. a basket of individual stocks hand-picked by an "active" portfolio manager because I’m simply not convinced that equity managers can consistently beat an index on a pre-tax basis, but many will charge a hefty fee for trying.

Only 5% of active portfolio managers will outperform an index over the last fifteen years—I’m not interested in placing my hard-earned savings with someone that has a 95% chance of lagging low-cost ETFs. I’ll just learn to live with benchmark-level pre-tax returns.

But tax alpha does exist (beating benchmark returns on a post-tax basis), as I described in the prior article. And some-managers have developed models to optimize tax loss opportunities and maximize tax alpha. This makes active management a worthwhile endeavor, in some respects.

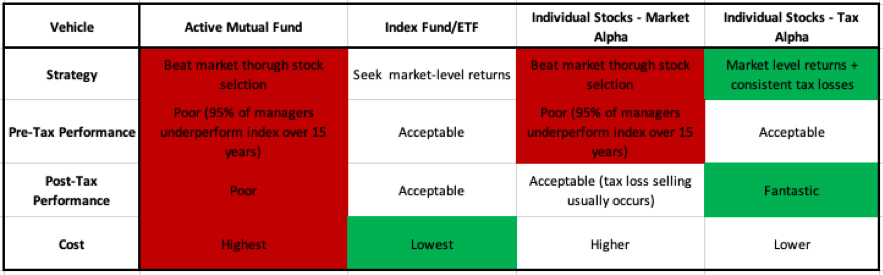

Here’s a rundown of traditional investment vehicle options for someone that wants exposure to the S&P 500 in a taxable (non-retirement) account:

Green=Positive White=Neutral Red=Negative.

The least attractive option for stock exposure, in my opinion, is an open-ended mutual fund. Economic performance aside, mutual funds have high cost and can create taxable income through capital gains distributions.

Individual stock strategies seeking "market" alpha (superior pre-tax returns) are better than mutual funds because of lower cost and the opportunity to sell losses on individual positions (rather than one mutual fund holding). These strategies often mirror active mutual funds in that they hold significantly fewer positions than an index and seek to beat the index on a pre-tax basis. They’re also a little cheaper than mutual funds.

Passive index funds and ETFs are an excellent option for smaller or DIY investors with a buy and hold. These funds are more tax efficient than active mutual funds but won’t offer much in the way of tax loss selling. It’s a single holding that will appreciate substantially over time, and there just isn’t much opportunity to consistently capture losses.

The final category, which is the topic of this article, is sort of like a personalized ETF built with individual stocks. The economic performance will mirror the benchmark, but with hundreds of holdings, there is always something to sell for a tax loss, which increases tax alpha and generates superior after-tax returns. Here’s an example:

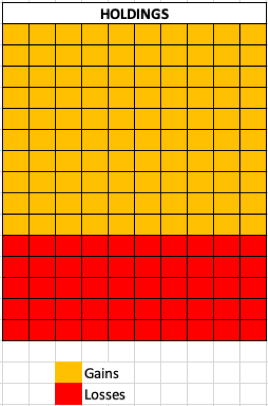

Assume your tax loss strategy holds 150 positions and seeks to mirror an index. At the end of the year there are 100 positions showing a gain (in the green) and 50 positions showing a loss (the red). The strategy will systematically sell the red positions and move the proceeds into holding with similar market exposure, exactly as I discussed in the last article.

So why is this different?

For two reasons. First, there are more holdings (and tax loss sale opportunities) than the mutual fund, ETF or individual stock market alpha strategy.

Second, because the decision to sell is made for tax reasons, where a market alpha strategy will continue to hold a loss because of fundamental investment reasons, ie. “We still really love this stock…”, etc.

In formulating buy/sell purely on the basis of (1) mirroring the index and (2) capturing tax losses, you are setting your economic return baseline at or very close to the index but generating meaningful tax losses.

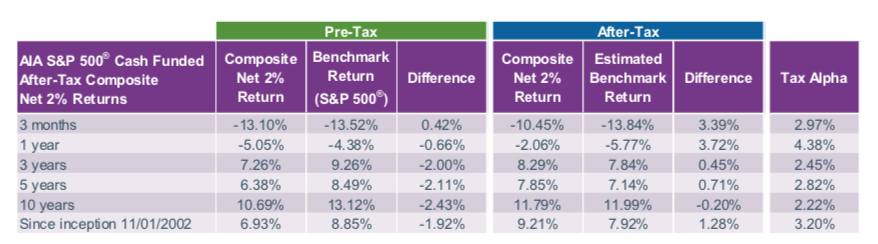

The results are actually very impressive. Some of these strategies have been in place for nearly twenty years and have delivered on their goal. Here’s a snapshot of an actual S&P 500 quantitative tax loss strategy, net of 2% fees, which is much more than anyone should pay.

NOTE: THIS IS NOT AN ENDORSEMENT, BUT IS FOR ILLUSTRATIVE PURPOSES ONLY. THIS IS NOT A STRATEGY MANAGED BY CLARO ADVISORS, LLC.

The core takeaway is that the tax loss selling strategy has added over 3% of annualized after tax returns from 11/1/2002 through 12/31/2018. That is consistent value over a meaningful time period. Note, this assumes the highest federal tax rates, which may not always apply. If tax rates area lower, so is "tax alpha."

Who Is This For?

High earners (32% federal bracket and higher) with more than $100,000 to invest.

Loss Limitations

You may not be able to use 100% of tax losses in a given year. These are “capital losses” that can (1) first reduce capital gains and (2) then reduce ordinary income by up to $3,000. In some years there will be more losses than an investor can take. For example, if the account produces $1,000 capital gains and $5,000 in capital losses, the investor would first net losses against gains for a net capital loss of $4,000. After that, the investor could apply $3,000 of losses against other income.

That means there’s a $1,000 loss that doesn’t help this year, but investors can carry losses forward to future years.

Disclosure: Claro Advisors LLC ("Claro") is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Claro and it's representatives are properly licensed or exempt from licensure.

Past performance shown is not indicative of future results, which could differ substantially.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab