Stoicism and Financial Decision-Making

In common use, the term “Stoic” describes someone that is confident, quiet, stable and purposeful.

Stoicism, however, is an Ancient Roman philosophy that provides practical life advice for anyone wishing to better themselves. Legendary entrepreneur Tim Ferriss described Stoicism as a “personal operating system”. High performing Stoicism-enthusiasts include Bill Belichick, Nick Saban, Bill Clinton, Ralph Waldo Emerson, and Theodore Roosevelt.

Ryan Holiday, a successful entrepreneur and author of practical Stoicism-inspired books The Obstacle Is the Way and Ego Is the Enemy, publishes a helpful website called The Daily Stoic, which serves as a manageable introduction to Stoic philosophy. After reading Holiday’s works, it seems that core stoic principles could provide a sound guide for major wealth management decisions.

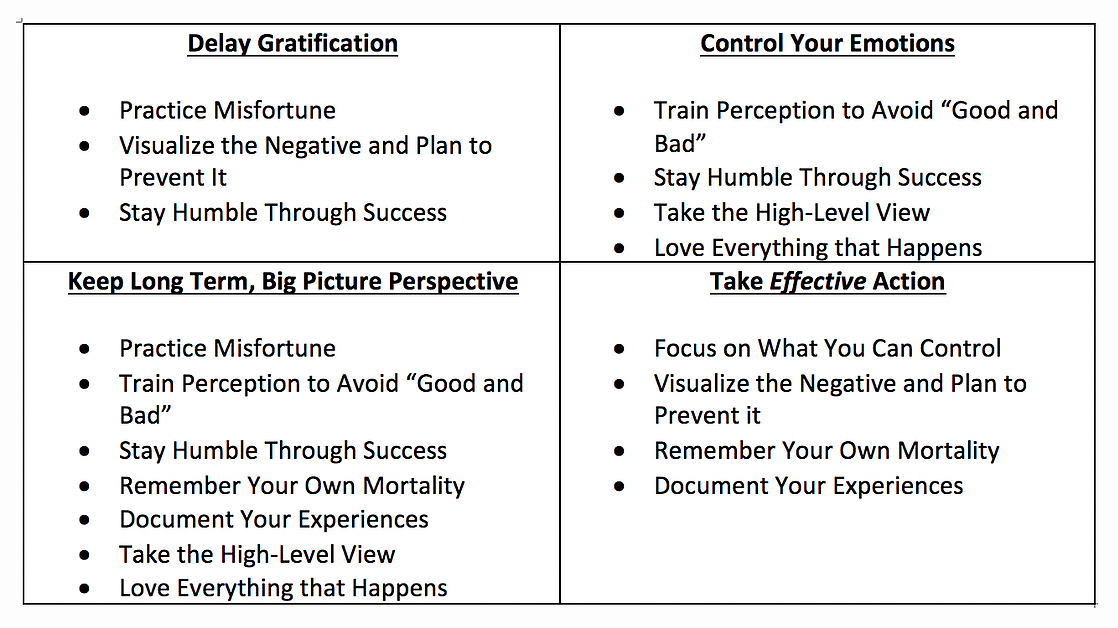

In the article below, I describe Holiday’s nine Stoic practices and further categorize them into four core wealth management behaviors. I then give examples of these four behaviors in various areas of wealth management best practices.

First, a quick description of the rules via Holiday’s post (please read his article, I may not do it justice).

- Practice Misfortune – Famous Stoics suggested setting aside a few days each month to “practice poverty” to simulate an impoverished life. After a few days of living one’s worst nightmares, most folks see that it’s actually not so bad, and likely temporary and/or reversible. After this realization, individuals will operate with less anxiety and fear.

- Train Perception to Avoid “Good and Bad” – Turn your tough experiences into “teachable moments” or even potential opportunities. Stoicism advocates for (1) learning from the experience and/or (2) seeing new opportunities after an unfortunate event, rather than focusing on the negative past.

- Stay Humble Through Success – Success can change people if they let it. Folks should retain perspective throughout success and keep strong values. Be nice to people, do the right thing. If you fail to do that, you may suffer when circumstances change. Achievements go away, fortunes fade, but one's character should never change.

- Take the High-Level View – Considering the totality of human experiences helps us understand the insignificance of our own situation. The long-term, high-level view minimizes our small, petty worries. If you can’t tell, Stoicism is all about perspective.

- Remember Your Own Mortality, Every Day – We’re not immortal, and could pass at any time. Live each day purposefully and be mindful of your legacy. This is not an excuse for reckless behavior, but a reminder to use your time effectively.

- Focus on What You Can Control – Holiday says, “The single most important practice in Stoic philosophy is differentiating between what we can change and what we can’t.” Focus your efforts on areas that (1) you can control and (2) actually matter. Once you apply these criteria, many worries vanish.

- Document Your Experiences – The Stoic practice journaling helped many, from slave to emperor, document their daily actions to examine their results, and behave more effectively going forward. Many Stoics also describe the process of self-examination to be not only practical but therapeutic.

- Visualize the Negative, and Plan to Prevent It – Consider all the ways things could go wrong, and plan for them. That’s it. Pretty simple, but how many of us do this effectively?

- Love Everything that Happens – Good, bad, ugly—you must learn to love it all. Accept and make the best of every situation.

We can classify these practices into four behavioral rules for decision making and action. Some principles fit into multiple rule categories.

Four Rules

1. Delay Gratification

2. Control Your Emotions

3. Keep Long-Term, Big Picture Perspective

4. Take Effective Action

If we then think about these four core ideas that flow from Holiday’s nine principles, is there really any better financial and wealth management advice? Let’s consider how certain wealth management practices fit within these core ideas.

1. Delay Gratification

The basic formula for long-term wealth is to spend less than you earn and invest the difference to achieve long-term, compounding returns. You are foregoing present consumption for the future benefit—this the definition of delayed gratification. The same concept also applies to consider what could go wrong in the future and planning for it (insurance and estate planning?) Sure, it’s not fun having these conversations or paying for lawyer fees or insurance premiums, but we know that our future selves will thank us for today’s disciplined decisions.

Actual Examples

- Maximizing Savings for Stated Goals (Down Payment, Retirement, College Funding)

- Taking Equity Rather Than Cash Compensation

- Seeing Value in Appropriate Estate Planning and Insurance Strategies

- Living Within Your Means

- Leveraging Tax-Free and Deferred Accounts (401k, IRAs, HSAs, Roth IRAs)

- 2. Control Your Emotions

The research has shown, time and time again, that emotion prevents the biggest threat to our long-term investment returns. It’s unlikely that one can meet financial goals without achieving a certain level of investment return over the long term. An entire academic and professional discipline (behavioral finance) has developed in response to our history of frantic investment behavior. The investment behavior gap explains how emotional decisions wreak havoc on retirement savings, with the average stock investor underperforming their own funds by double digits over decades of investing, mostly due to hasty buys and sells.

Stoicism preaches the proper way to invest—buy, hold and go back to developing more strategies to increase income and decrease expenses. The last thing you should do is stare at the market, read quarterly earnings or speculate on the future market performance.

Actual Examples

- Buy and Hold Investing

- Becoming Market Agnostic

- Avoiding Lifestyle Creep to “Keep Up with the Jones’”

- Diversifying Away from Concentrated Positions

- Avoiding the “Hot” Investment Strategies

- Rebalancing Investment Accounts

3. Keep Long Term, Big Picture Perspective

The first step in developing your financial plan is to set goals, which are adaptable and adjustable at any time. The key is to never exhibit behavior that undermines one’s stated goals. In other words, to make a football analogy—the goal is to win the game. Why try and score a touchdown if a field goal could win the game? Don’t be reckless. The desire to win big actually undermines the goal of winning. This “I have enough, but I want more” type of mentality is kryptonite for long-term financial goals. Taking a long-term, big-picture view allows us to understand and love the concept of “enough” when it comes to meeting our goals.

Actual Examples

- Develop a Goals-Based Financial Plan

- Rebalance Your Portfolio

- Keep Track of Everything

4. Take Effective Action

The criteria for effective action is that (1) it is within your control and (2) it actually matters. Sometimes we take action, but the outcome is not truly within our control (stock picking, market timing, emotional investing), other times we can control an outcome, but it really has no material effect on our overall financial well-being—it just feels good. I remember having a friend in college that would walk an extra fifteen minutes to save $1.50 on ATM fees, or some folks that drive ten miles out of their way to save $1 on a tank of gas. These folks have technically saved money, but not enough to matter, and they’ve also cost themselves significant time and convenience.

There is no more futile and emotionally taxing action than “watching the markets” and trading to beat them. In the end, the research shows, folks can’t outperform an index fund—and they will never retrieve that time or emotional investment.

Examples of Non-Effective Actions

- Waiting in Line for 45 Minutes for a “Free” Burrito

- Selling All Investments Based on Geopolitical Concerns After Watching CNN

- Picking A Portfolio Based on Last Year’s Highest Performing Mutual Funds

- Listening to a Broker’s “Hot Stock Tips”

Example of Effective Actions (Hint: Meaningful Savings Opportunities)

- Examining Your Tax Return for Planning Opportunities

- Scrutinizing Your Budget

- Analyzing and Maximizing Your Employee Benefits Package

- Reviewing Your Current Loans for Refinancing Opportunities

- Investing Additional Savings in Index Funds and Going Back to Work

Despite the diverse financial situations of Americans, the adoption of an evidence-based, long-term, disciplined approach to finances can add value over the short-term, emotional behavior that guides most financial decisions.

The next time you’re faced with a major financial problem, apply a little Stoicism and watch the magic happen.

If you need help, schedule a call with Claro Advisors here.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). Information contained herein is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Information contained herein is taken from sources believed to be reliable, but cannot be guaranteed as to its accuracy. It is for informational and planning purposes. Nothing herein shall be construed as an offer or solicitation to buy or sell any securities. Nor is it legal or accounting advice. Investing carries risks and expenses and involves the potential loss of investment. Past results are not indicative of future results.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab