Obligatory Investment Outlook (2019)

Just a Quick Note on Annual Investment Outlooks…

Each year, seemingly thousands of financial institutions, professional investors and everyday financial advisors provide a forward-looking outlook for the coming year. These outlook papers serve as forward-looking predictions for the market and economy. Ostensibly, investors leverage these insights to position their portfolios for success.

There is no shortage of intellectual geniuses in the investment community. For decades, the brightest, most ambitious go-getters from all over the globe have flooded into asset management firms in search of their investment fortune. I won’t pretend to be half as smart as these folks. I’m not a CFA, nor do I play one on TV.

But I will note that no amount of IQ, hard work or professional certifications can help someone predict the future, and the phenomenal minds within the finance industry are no exception. Short term predictions have proven to be completely futile, but based on the amount of knowledge, effort, and skill that goes into the “yearly outlook” papers, we would expect these experts to have better luck with longer-term macro trends.

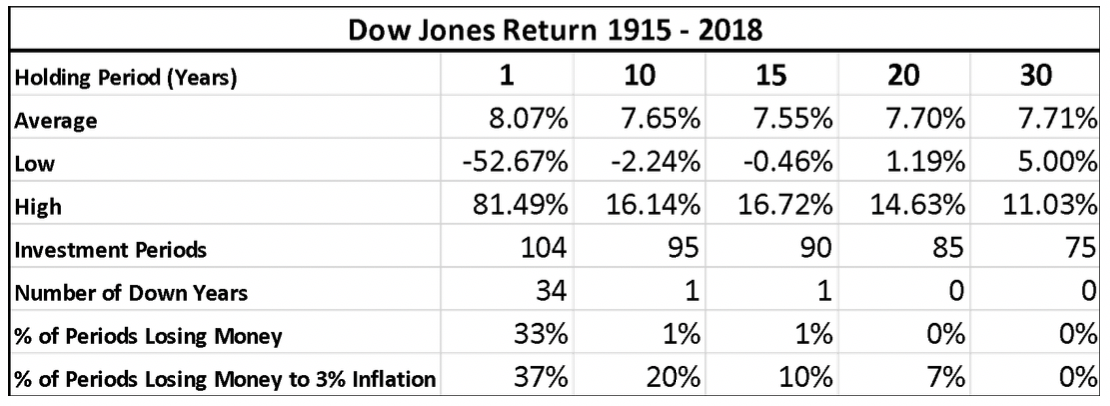

For example, it’s virtually impossible to consistently predict the short-term behavior of the markets. Conversely, it’s somewhat simple to predict the longer-term behavior of markets—they always go up over the long term. Here are some statistics on the Dow Jones Industrial Index from 1924 – 2018:

A few takeaways…

- Equity investing over one year is gambling. The returns are widely dispersed and provide low security or reliability for making any sort of financial plan. If your investment horizon is one year, do not invest in equities.

- For Investors with a holding period of 30 years (for which there were 75 total 30-year rolling periods since 1924), no one lost money (either absolute or relative to inflation) and the worst investor had an average return of 5% per year. This unlucky fellow held from 1956 – 1985, and if he invested $100,000, only made a cumulative return of almost $312,000. If that $100,000 was invested over the course of a career (say by 401(k) contributions), returns would have been higher.

- Investors with holdings periods between 10 and 25 years all fared pretty well, with less than 1% losing money on an absolute basis and about just above 10% losing money against 3% inflation. The 10-year numbers don’t look great but keep in mind that:

a. They are light years better than the one-year numbers, and;

b. Ten years is a short holding period for equities. If most people start working and saving in their twenties and they live until their seventies, that puts most holding periods around 50 years.

And now I have some general questions about the annual investment outlook process:

- Why are we so focused on one-year predictions?

- Why do we pretend that these predictions might be accurate, let alone a useful source for action steps?

- Why is the annual outlook considered a “long-range” view when most people will be in the market for 40, 50 or 60 years?

I’m not writing this to say that investment outlooks don’t provide interesting information, or that their authors aren’t seeking good faith conclusions based on empirical data. I’m saying that annual investment outlooks do not provide reliable predictions that would support actionable advice on portfolio management.

I can’t fathom a circumstance where an annual investment outlook would have any sort of priority in dictating my short-term personal finance action items (those actions I will take over the next year).

Everyone wants to “time the market” based on expert predictions. The smartest investors, like Howard Marks at Oaktree Capital, have a much better view on utilizing data, experience, and knowledge to predict trends. He explains it here from a recent interview:

“The future is a distribution of possibilities, and if we’re really smart, we know what the possibilities are, and we may have an idea of which are more likely and less likely, but we still don’t know what’s going to happen, and I think we have to behave that way.”

More specifically, when referencing the markets during the last financial crisis, Marks is mostly concerned with the overall longer-term economic cycle—which can go over several years (emphasis added):

One of those most important things is knowing where we stand in the cycle. As I say, I don’t believe in forecasts. We always say, “We never know where we’re going, but we sure as hell ought to know where we are.” I can’t tell you what’s going to happen tomorrow, but I should be able to assess the current environment, and that’s the kind of thinking that helped us prepare for the crisis. I think that the two most important things are where we stand in the cycle and the broad subject of risk, and in fact, where we stand in the cycle is the primary determinant of risk, so I think that this is a really important topic and it can really help you do better.

So, there it is from one of the best investors of all time. Focusing on where we are in the cycle is the key indicator of risk, which in turn is a key factor in weighing future probabilities.

With that being said, here is my 2019 investment outlook:

Official 2019 Investment Outlook

We are very late into the current economic cycle, and deep into an equity bull market. For that reason, the risk of a market downturn is higher than average based on historical statistics.

As a result, you should:

- Evaluate, understand and confirm the time horizon for your investments.

- Continue to focus on what you can control, which includes:

a. Keeping your portfolio balanced and diversified

b. Harvesting tax losses

c. Minimizing fees and expenses

d. Engaging in consistent, meaningful financial planning to increase your savings rate and investment contributions over time

If you need help with any of the above, please schedule an intro call.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab