Human Advisors Are Irreplaceable (For Now)

Competent investment management is a commodity service—and this is no secret.

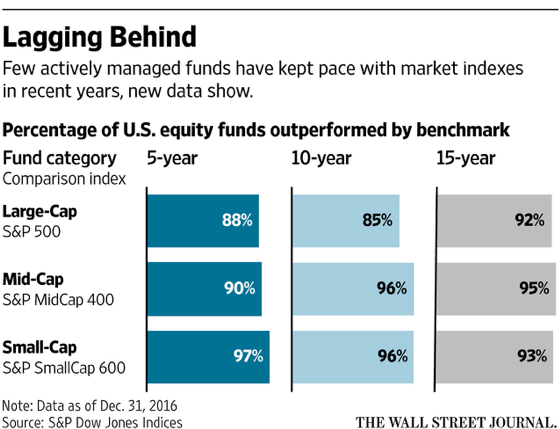

For the past decade, institutional and retail investors alike have chosen low-cost passive index funds over higher cost actively managed strategies because active managers can’t consistently beat the index, but still, charge high fees for trying. Here are the numbers for active managers vs. the index from a Wall Street Journal article:

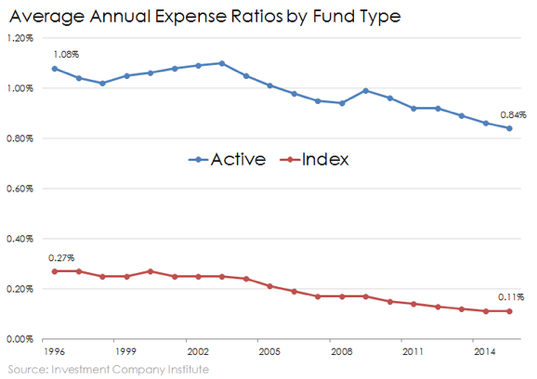

And here are the average annual expense ratios for active vs. index funds.

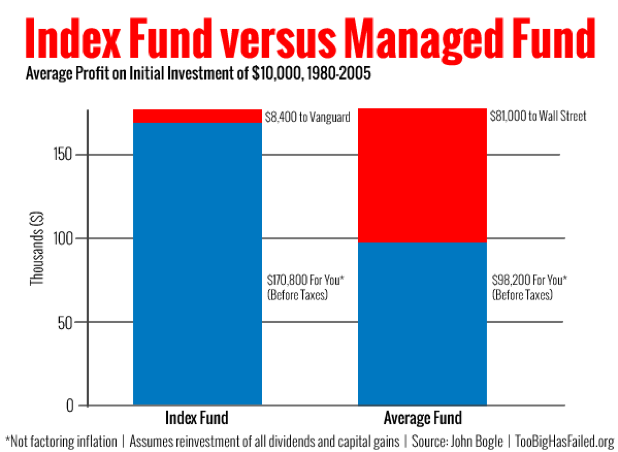

Active managers beat the market less than 10% of the time but charge many multiples in fees. If gross performance is equal, here’s how an investor performs over twenty-five years in a Vanguard ETF vs. an active fund.

This is a profound revelation, yet not news to many experienced investors. Despite the overwhelming simplicity and effective results of passive equity funds, active managers and investors still seem to find each other—likely at their own peril.

I’ll ignore the active folks for now—they have enough problems! Today, my gripe is with the growing group of smart, savvy Americans that “see the light” with passive investments, but mistakenly conclude that the downfalls of active investing support an indictment against the entire financial advice industry. The DIY investors love Vanguard, and many others love “Robo-advisors” like Wealthfront, Betterment, and Personal Capital—these companies provide managed passive investment portfolios for a fraction of human advisor costs.

While low-cost investment management creates wonderful efficiencies for investors of all sizes, it is not a comprehensive solution for those without the knowledge and temperament to take consistent actions in building long-term wealth. And that’s where the human advisor helps.

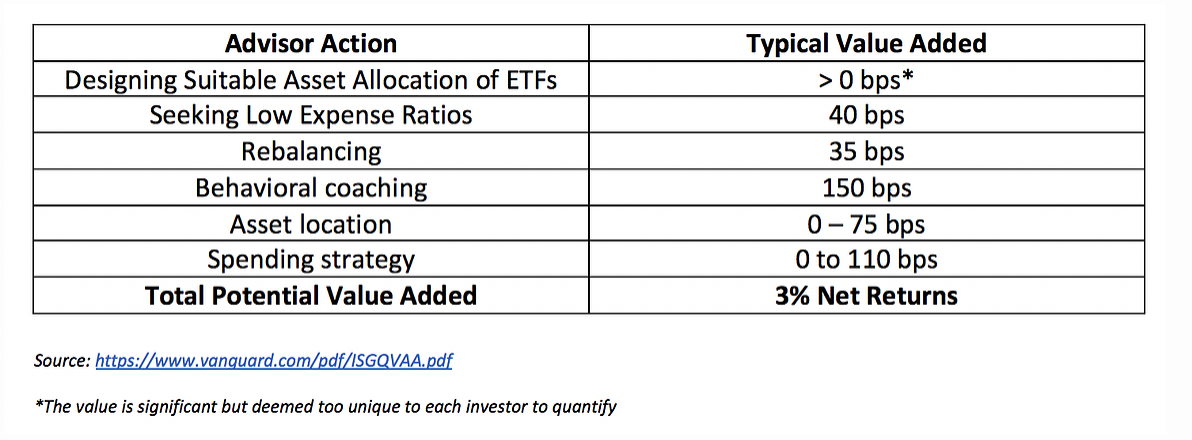

Vanguard—the holy grail for DIY passive investors—published a study that sought to quantify advisor value to an investment portfolio over the long term. They call this the “Advisor Alpha”.

Here’s the quick and dirty from Vanguard’s study on advisor value to an investment portfolio over time:

Findings? Picking the “best stocks” does not beat the market. Rather, creating a fundamentally sound investment strategy and sticking to it despite occasional emotionally-fueled urges to buy or sell will create alpha (returns above market) over time.

Even with cheap, direct-to-consumer investment options, human advisors provide significant value through soft skills of behavioral coaching, and hard skills of proper asset location, withdrawal strategies, and rebalancing.

Behavioral coaching is the biggest value-add. This comes as no surprise after when considering the much documented “behavior gap”—the phenomenon where most investors underperform their own investments due to emotionally-fueled buys and sells. Competent advisors can help investors avoid these pitfalls.

Robo-advisors seek to close this investment behavior gap, but here’s an interesting fact: Even Robo-advisors, and Vanguard, have spent millions to hire human financial planners in the past few years.

Why? Because passive investment management solves one (and only one) personal finance issue facing folks today. Humans advisors are experts in equally important areas outside of investment management.

The True Advisor Value Proposition

Good advisors provide knowledge, action-steps, and accountability so that individuals can maximize their savings rate and efficiently apply the savings to short and long-term financial goals.

Increased savings and goal prioritization are imperative to building long-term wealth. An equity index fund has minimal value if you can’t save money or have to sell positions to fund living and tax expenses.

Every area of your financial life should be optimized for increased savings for long-term goals: Do you have all these areas optimized?

- Living Expense Budget

- Retirement Contributions

- Stock Compensation and Equity Awards

- Employee Benefits

- Income Tax

- Estate Tax and Asset Distribution

- Insurance and Liability Protection

- Charitable and Philanthropic Planning

Human advisors comb through these areas to uncover planning opportunities where a slight tweak now can mean more savings invested each year. Over time, this makes a huge difference in wealth.

Low-cost investment management and even “robo-advice” has yet to supplant this type of service by capable financial planners and/or advisors.

So Where's the Love for Human Advisors?

First, confusion. Many folks just getting “hip” to investment fees truthfully don’t understand that advisors operate areas outside of investments or insurance. And that’s because…

Second, most advisors don’t provide the type of planning and service needed to justify their fees. They manage client investments and do nothing else. Or worse, they sell the client unnecessary products an earn a commission. There is no value in this type of service—and these “advisors” will go the way of the dodo in decades to come.

Third, DIY folks can figure it out for themselves and don’t see any value in paying a professional. A very handy homeowner wouldn’t pay a plumber $75 dollars to turn a wrench under the sink. All the best to competent DIY folks. But what about everyone else?

Even with cheap home improvement stores and free YouTube instructional videos—most folks are happy to spend hundreds or thousands on home improvement and repair issues because they don’t want or need to break out their toolbox. Time is more valuable than money and having the peace of mind that it’s been “taken care of” has significant value to busy homeowners.

And even the most experienced handyman needs to call experts for major structural issues, highly skilled finish work, or jobs too big for one person.

The same is true for financial issues. While your average Boglehead can competently manage his or her IRA—can they sort through the plethora of issues when buying or selling a business? What about examining the tax consequences of start-up equity, stock compensation or complicated deferred compensation benefit packages? And I dare you to find a DIY index investor that can sort through complex estate tax planning issues.

Good advisors serve as the quarterback for all of these things so that clients can focus on their highest return activities. Family, fun, career, or anything else.

In today’s world, expert advice is available to folks for a cost that is consistent with meeting all long and short-term financial goals.

There is no replacement for competent, honest and hard-working advisors.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab