Stop Avoiding Decisions on Equity Compensation: Part I - The Basics

Make Hard Decisions Now For Better Results Later

Equity compensation is a broad category of various ownership grants given to employees, founders and investors throughout a company’s lifecycle. If managed properly, equity compensation can provide an economic windfall that turbo charges a wealth plan.

But equity compensation can be confusing and intimidating. Reviewing stock options and restricted stock units (RSUs) can feel like walking through a minefield of complex legal documents, tax rules and what-ifs. Common questions I hear from clients include:

· What do I own?

· What is it worth?

· Do I owe any taxes?

· What is AMT?

· Should I exercise/sell/hold?

· What if the company grows, folds or explodes?

· If I sell, how should I invest the proceeds?

All this confusion and uncertainty mainly leads to one thing: Avoidance. Folks just go back to working and living their lives and defer making any sort of real decision about equity.

Unless they work with a financial planner, that is…but we’ll get to that later.

Like many other areas of wealth management (and life), there are some best practices and simple concepts to apply here that almost anyone can understand. If you understand these fundamentals, decisions become a lot easier.

In this first portion of a three-part installment on equity compensation, I want to explain stock options and RSUs from a conceptual standpoint so that folks can understand that two clear themes:

1. Before IPO, equity compensation decisions are about saving taxes on future growth.

2. Post IPO, equity compensation decisions are about diversifying away from company stock and towards your own personal wealth plan and goals.

This is a big spectrum and timeline. It ranges everywhere from inception to decades on the public markets.

The core goal of managing equity compensation is this: Take home as much as you can, and if you receive a windfall, keep it forever (don’t let it ride hoping for future growth). Use equity compensation to start building your freedom package.

Equity in young companies can provide UPSIDE: The goal is to “pre-pay” taxes on that future upside by early exercise of stock options, or recognizing taxable income when the equity has minimal value.

Decision Leverage - Plan Your Trip Ahead of Time: Think about going on vacation. With every trip there is one traveler that excels as the “planner”. They sketch out the entire trip, leverage credit card points, research discounts, and prepay whenever it saves them money. Planning for equity compensation is no different—you can prepay your taxes at a seriously reduced rate.

Either pay a little now, or a lot later. That’s because after you exercise options, any gain going forward will be a capital gain (20%), rather than an ordinary (up to 37%) or AMT gain (28%).

But there’s a risk involved, because there may not be any “later” with an early stage company. If you prepay all of your hotel rooms, but have to cancel your trip last minute, you might lose your money.

And if things don’t work out for your company, you’ve lost your investment. So then rule for early stage planning is:

IF the company is more likely than not (based on all available information) to grow beyond the current stock price value, THEN I should exercise/buy/recognize taxable income on my shares now and capture future growth in a preferential tax bracket.

If planning decisions are deferred until the company matures in value of early tax planning diminishes and the cost to purchase/exercise/recognize shares increases. The tradeoff is that folks feel a little safer about making this investment because the company has shown promise.

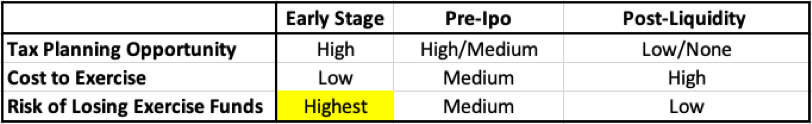

So here are the core factors with early stage equity compensation planning that we should define:

1. Tax Planning Opportunity– early exercise costs a little tax money NOW to save a lot LATER (on future growth)

2. Buy In– Total cost to exercise your shares (cost of shares PLUS tax liability)

3. Risk of Loss – Chances that you will lose money on your investment

Here’s how these items rank over time, from early stage to post IPO/liquidity.

Post-Liquidity: Quite simply, post-liquidity equity compensation planning is about diversification away from the company and “managing your windfall”.

Whether you decide sell shares that were early-exercised options (if you were diligent), or selling RSUs as they vest—you now have a different rule:

IF you can make significant progress towards long term financial goals by selling a concentrated position, THEN you should sell.

As companies mature, the factors shift. Tax planning opportunities wain, the buy in and opportunity costs become higher, and risk of loss starts to diminish.

By the time a company has had a few years in the public market, there are little planning opportunities, risk of loss is low or gone, but opportunity costs grow to a point where selling one’s shares is compelling.

This is the dilemma that many long-time employees at public companies face: I’ve had a windfall, but what if I sell and the company keeps doing well? Won’t I regret selling?

Yes, but you can absorb the opportunity cost of losing out on potential future growth in exchange for meeting financial goals NOW. You CANNOT afford losing what you already have. All of your “windfall” is now subject to risks way outside your control and could go “poof” at any time. Take your chips off the table and protect your wealth from risks inherent in your specific company and industry. (More on this in Part III).

In summary, early stage planning is about preferential tax treatment. Post liquidity planning is about taking chips off the table with intention and mindfulness towards a larger financial plan.

Next up, in Part II, we'll dig a little deeper into the pre-IPO option exercise strategy.....

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us here with any questions.

Related Articles

- An Effective Stock Option Strategy for Startup Employees

- Dear Young Investors: Stop Micro-Managing Investments and Become Market Agnostic

- What To Do With All Those RSUs?

- Effective Financial Planning for Young Professionals

- My Company Was Acquired - Now What?

- Stop Avoiding Decisions on Equity Compensation: Part II - Early Stage and Pre-IPO

- Stop Avoiding Decisions on Equity Compensation: Part III - Don't Let FOMO Ruin Your Finances

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab