Effective Financial Planning for Young Professionals

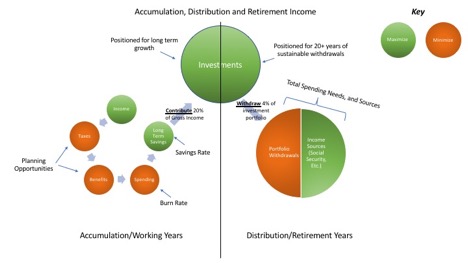

There are two stages of retirement planning - accumulation and distribution.

There are two stages of retirement planning - accumulation and distribution. Accumulators are those still working (and who we’ll discuss here). Distributors are those that are no longer working and live off their assets and passive income streams (to be discussed later).

Here’s a graphic showing the lifecycle of a good financial plan from working years (accumulation phase) to retirement years (distribution phase).

The term “Financial Plan” means many things to many people. For those currently working, it’s all about increasing the savings rate and making efficient savings choices based on various long and short-term goals.

For retirees, the goal is to take sustainable portfolio withdrawals and not outlive your money.

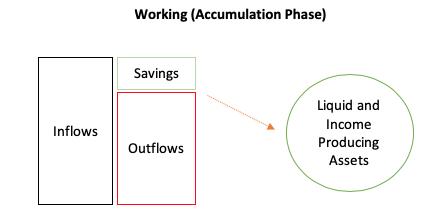

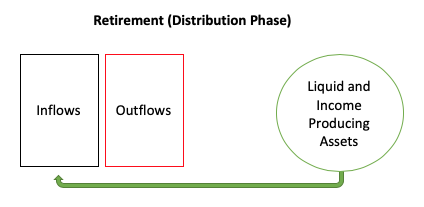

Here’s a simplified trajectory of successful retirement planning:

A portion of retirement inflows will come from Social Security, pensions and part-time work, but I’ve left that out here to focus on the important concept that the existing capital will provide the lion’s share of income for retirees.

Now let’s talk about where to focus.

Accumulation Phase

The core goal during accumulation phase is always to maximize savings rate and efficiently apply savings to short and long-term priorities. While technically true, this isn’t exactly a practical tip. It’s sort of like saying “The key to losing weight is to experience a sustained caloric deficit.” We need more than to act! So here it is..

Step One – Set Your Priorities: This is something only you can do. Common priorities include retirement, education, purchasing a home, reducing debt, etc. An increasingly popular priority is to take a sabbatical from work for a few years or a “mini-retirement”.

Step Two – Maximize Take Home Pay with Tax and Benefits Planning: Again, this means many things to many people. Some folks have complex situations with endless planning opportunities (business owners, startup founders and early employees, executives) while others have simpler financial lives (teachers, nurses, employees). Regardless of the situation, maximizing take-home pay means mastering your tax and benefits planning. Optimize everything here. Tax and benefits planning present the greatest savings opportunities.

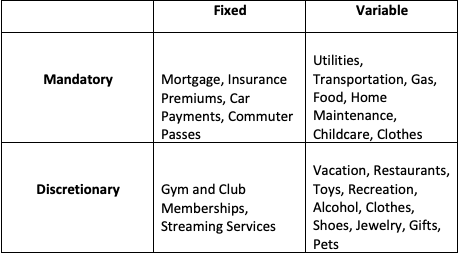

Step Three – Cut the Fat: In the age of apps, subscription services, memberships and digital transactions it’s very easy to lose track of where our money goes each month. Sit down and develop a plan to avoid lifestyle creep. Make the following distinctions with your expenses – Mandatory/Discretionary and Fixed/Variable. It might look like this…

Step Four – Give Every Dollar a Job: The hard part is over, you’ve saved the money. Now spread it out over different buckets earmarked for specific goals and priorities. Retirement, education, healthcare spending, down payment, home renovation, or mini-retirement. Investment strategies for each bucket depend on planned withdrawal date. Retirement funds can withstand volatility to achieve long-term growth, while shorter-term goals like down payments and home renovations should be in stable, principle preserving investments like treasuries and cash.

This is the part where folks get squeamish.

-

Roth or Traditional?

-

How do I invest?

-

What happens if a war breaks out of the President is impeached?

-

Are we in a bubble?

As an investor in the accumulation phase, it’s all about time in the market. Don’t attempt to beat the market, or make emotional buys or sells, just gain broad exposure to world equities through low-cost funds and go back to saving more money.

Disclosure: Claro Advisors, LLC ("Claro") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this post is for educational purposes only and is not to be considered investment advice. Claro provides individualized advice only after obtaining all necessary background information from a client. Please contact us This email address is being protected from spambots. You need JavaScript enabled to view it. here with any questions.

EMoney

EMoney Fidelity

Fidelity Schwab

Schwab